Page 21 - cfi-Accounting-eBook

P. 21

The Corporate Finance Institute Accounting

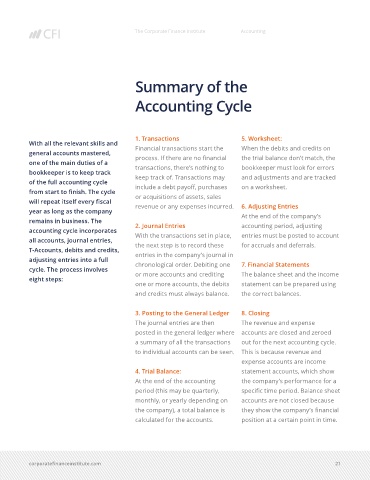

Summary of the

Accounting Cycle

1. Transactions 5. Worksheet:

With all the relevant skills and Financial transactions start the When the debits and credits on

general accounts mastered, process. If there are no financial the trial balance don’t match, the

one of the main duties of a transactions, there’s nothing to bookkeeper must look for errors

bookkeeper is to keep track keep track of. Transactions may and adjustments and are tracked

of the full accounting cycle include a debt payoff, purchases on a worksheet.

from start to finish. The cycle or acquisitions of assets, sales

will repeat itself every fiscal revenue or any expenses incurred. 6. Adjusting Entries

year as long as the company At the end of the company’s

remains in business. The 2. Journal Entries accounting period, adjusting

accounting cycle incorporates With the transactions set in place, entries must be posted to account

all accounts, journal entries, the next step is to record these for accruals and deferrals.

T-Accounts, debits and credits, entries in the company’s journal in

adjusting entries into a full chronological order. Debiting one 7. Financial Statements

cycle. The process involves or more accounts and crediting The balance sheet and the income

eight steps:

one or more accounts, the debits statement can be prepared using

and credits must always balance. the correct balances.

3. Posting to the General Ledger 8. Closing

The journal entries are then The revenue and expense

posted in the general ledger where accounts are closed and zeroed

a summary of all the transactions out for the next accounting cycle.

to individual accounts can be seen. This is because revenue and

expense accounts are income

4. Trial Balance: statement accounts, which show

At the end of the accounting the company’s performance for a

period (this may be quarterly, specific time period. Balance sheet

monthly, or yearly depending on accounts are not closed because

the company), a total balance is they show the company’s financial

calculated for the accounts. position at a certain point in time.

corporatefinanceinstitute.com 21