Page 18 - cfi-Accounting-eBook

P. 18

The Corporate Finance Institute Accounting

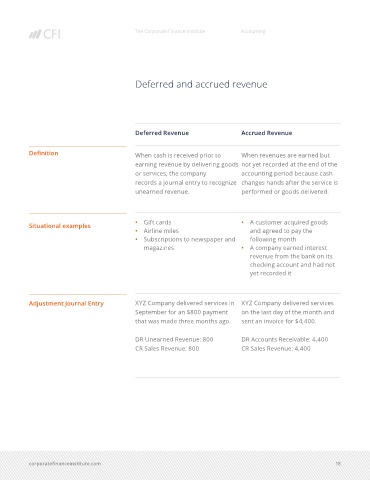

Deferred and accrued revenue

Deferred Revenue Accrued Revenue

Definition When cash is received prior to When revenues are earned but

earning revenue by delivering goods not yet recorded at the end of the

or services, the company accounting period because cash

records a journal entry to recognize changes hands after the service is

unearned revenue. performed or goods delivered.

• Gift cards • A customer acquired goods

Situational examples

• Airline miles and agreed to pay the

• Subscriptions to newspaper and following month

magazines • A company earned interest

revenue from the bank on its

checking account and had not

yet recorded it

Adjustment Journal Entry XYZ Company delivered services in XYZ Company delivered services

September for an $800 payment on the last day of the month and

that was made three months ago. sent an invoice for $4,400.

DR Unearned Revenue: 800 DR Accounts Receivable: 4,400

CR Sales Revenue: 800 CR Sales Revenue: 4,400

corporatefinanceinstitute.com 18