Page 166 - COMBINED QUESTIONS AND ANSWERS - EDITION 2019 - PART II_Neat

P. 166

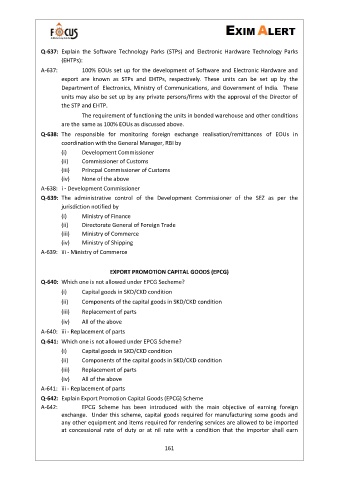

Q-637: Explain the Software Technology Parks (STPs) and Electronic Hardware Technology Parks

(EHTPs):

A-637: 100% EOUs set up for the development of Software and Electronic Hardware and

export are known as STPs and EHTPs, respectively. These units can be set up by the

Department of Electronics, Ministry of Communications, and Government of India. These

units may also be set up by any private persons/firms with the approval of the Director of

the STP and EHTP.

The requirement of functioning the units in bonded warehouse and other conditions

are the same as 100% EOUs as discussed above.

Q-638: The responsible for monitoring foreign exchange realisation/remittances of EOUs in

coordination with the General Manager, RBI by

(i) Development Commissioner

(ii) Commissioner of Customs

(iii) Princpal Commissioner of Customs

(iv) None of the above

A-638: i - Development Commissioner

Q-639: The administrative control of the Development Commissioner of the SEZ as per the

jurisdiction notified by

(i) Ministry of Finance

(ii) Directorate General of Foreign Trade

(iii) Ministry of Commerce

(iv) Ministry of Shipping

A-639: iii - Ministry of Commerce

EXPORT PROMOTION CAPITAL GOODS (EPCG)

Q-640: Which one is not allowed under EPCG Secheme?

(i) Capital goods in SKD/CKD condition

(ii) Components of the capital goods in SKD/CKD condition

(iii) Replacement of parts

(iv) All of the above

A-640: iii - Replacement of parts

Q-641: Which one is not allowed under EPCG Scheme?

(i) Capital goods in SKD/CKD condition

(ii) Components of the capital goods in SKD/CKD condition

(iii) Replacement of parts

(iv) All of the above

A-641: iii - Replacement of parts

Q-642: Explain Export Promotion Capital Goods (EPCG) Scheme

A-642: EPCG Scheme has been introduced with the main objective of earning foreign

exchange. Under this scheme, capital goods required for manufacturing some goods and

any other equipment and items required for rendering services are allowed to be imported

at concessional rate of duty or at nil rate with a condition that the importer shall earn

161