Page 213 - COMBINED QUESTIONS AND ANSWERS - EDITION 2019 - PART II_Neat

P. 213

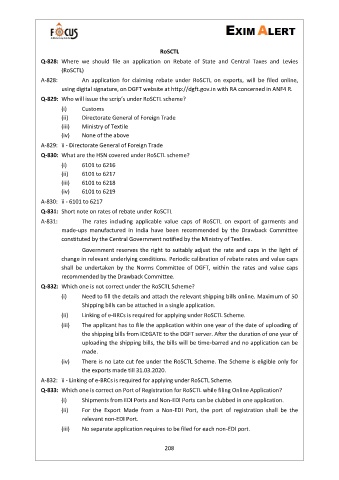

RoSCTL

Q-828: Where we should file an application on Rebate of State and Central Taxes and Levies

(RoSCTL)

A-828: An application for claiming rebate under RoSCTL on exports, will be filed online,

using digital signature, on DGFT website at http://dgft.gov.in with RA concerned in ANF4 R.

Q-829: Who will issue the scrip’s under RoSCTL scheme?

(i) Customs

(ii) Directorate General of Foreign Trade

(iii) Ministry of Textile

(iv) None of the above

A-829: ii - Directorate General of Foreign Trade

Q-830: What are the HSN covered under RoSCTL scheme?

(i) 6101 to 6216

(ii) 6101 to 6217

(iii) 6101 to 6218

(iv) 6101 to 6219

A-830: ii - 6101 to 6217

Q-831: Short note on rates of rebate under RoSCTL

A-831: The rates including applicable value caps of RoSCTL on export of garments and

made-ups manufactured in India have been recommended by the Drawback Committee

constituted by the Central Government notified by the Ministry of Textiles.

Government reserves the right to suitably adjust the rate and caps in the light of

change in relevant underlying conditions. Periodic calibration of rebate rates and value caps

shall be undertaken by the Norms Committee of DGFT, within the rates and value caps

recommended by the Drawback Committee.

Q-832: Which one is not correct under the RoSCTL Scheme?

(i) Need to fill the details and attach the relevant shipping bills online. Maximum of 50

Shipping bills can be attached in a single application.

(ii) Linking of e-BRCs is required for applying under RoSCTL Scheme.

(iii) The applicant has to file the application within one year of the date of uploading of

the shipping bills from ICEGATE to the DGFT server. After the duration of one year of

uploading the shipping bills, the bills will be time-barred and no application can be

made.

(iv) There is no Late cut fee under the RoSCTL Scheme. The Scheme is eligible only for

the exports made till 31.03.2020.

A-832: ii - Linking of e-BRCs is required for applying under RoSCTL Scheme.

Q-833: Which one is correct on Port of Registration for RoSCTL while filing Online Application?

(i) Shipments from EDI Ports and Non-EDI Ports can be clubbed in one application.

(ii) For the Export Made from a Non-EDI Port, the port of registration shall be the

relevant non-EDI Port.

(iii) No separate application requires to be filed for each non-EDI port.

208