Page 208 - COMBINED QUESTIONS AND ANSWERS - EDITION 2019 - PART II_Neat

P. 208

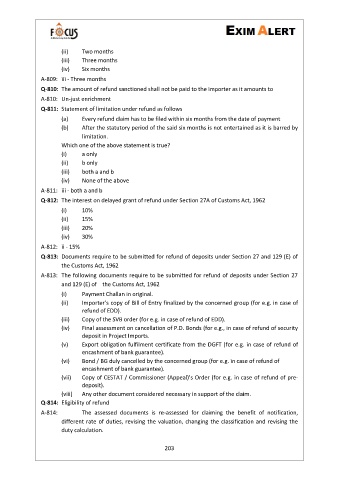

(ii) Two months

(iii) Three months

(iv) Six months

A-809: iii - Three months

Q-810: The amount of refund sanctioned shall not be paid to the importer as it amounts to

A-810: Un-just enrichment

Q-811: Statement of limitation under refund as follows

(a) Every refund claim has to be filed within six months from the date of payment

(b) After the statutory period of the said six months is not entertained as it is barred by

limitation.

Which one of the above statement is true?

(i) a only

(ii) b only

(iii) both a and b

(iv) None of the above

A-811: iii - both a and b

Q-812: The interest on delayed grant of refund under Section 27A of Customs Act, 1962

(i) 10%

(ii) 15%

(iii) 20%

(iv) 30%

A-812: ii - 15%

Q-813: Documents require to be submitted for refund of deposits under Section 27 and 129 (E) of

the Customs Act, 1962

A-813: The following documents require to be submitted for refund of deposits under Section 27

and 129 (E) of the Customs Act, 1962

(i) Payment Challan in original.

(ii) Importer’s copy of Bill of Entry finalized by the concerned group (for e.g. in case of

refund of EDD).

(iii) Copy of the SVB order (for e.g. in case of refund of EDD).

(iv) Final assessment on cancellation of P.D. Bonds (for e.g., in case of refund of security

deposit in Project Imports.

(v) Export obligation fulfilment certificate from the DGFT (for e.g. in case of refund of

encashment of bank guarantee).

(vi) Bond / BG duly cancelled by the concerned group (for e.g. in case of refund of

encashment of bank guarantee).

(vii) Copy of CESTAT / Commissioner (Appeal)’s Order (for e.g. in case of refund of pre-

deposit).

(viii) Any other document considered necessary in support of the claim.

Q-814: Eligibility of refund

A-814: The assessed documents is re-assessed for claiming the benefit of notification,

different rate of duties, revising the valuation, changing the classification and revising the

duty calculation.

203