Page 204 - COMBINED QUESTIONS AND ANSWERS - EDITION 2019 - PART II_Neat

P. 204

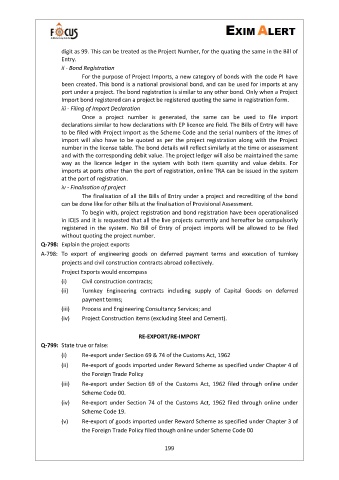

digit as 99. This can be treated as the Project Number, for the quating the same in the Bill of

Entry.

ii - Bond Registration

For the purpose of Project Imports, a new category of bonds with the code PI have

been created. This bond is a national provisional bond, and can be used for imports at any

port under a project. The bond registration is similar to any other bond. Only when a Project

Import bond registered can a project be registered quoting the same in registration form.

iii - Filing of Import Declaration

Once a project number is generated, the same can be used to file import

declarations similar to how declarations with EP licence are field. The Bills of Entry will have

to be filed with Project Import as the Scheme Code and the serial numbers of the itmes of

import will also have to be quoted as per the project registration along with the Project

number in the license table. The bond details will reflect similarly at the time or assessment

and with the corresponding debit value. The project ledger will also be maintained the same

way as the licence ledger in the system with both item quantity and value debits. For

imports at ports other than the port of registration, online TRA can be issued in the system

at the port of registration.

iv - Finalisation of project

The finalisation of all the Bills of Entry under a project and recrediting of the bond

can be done like for other Bills at the finalisation of Provisional Assessment.

To begin with, project registration and bond registration have been operationalised

in ICES and it is requested that all the live projects currently and hereafter be compulsorily

registered in the system. No Bill of Entry of project imports will be allowed to be filed

without quoting the project number.

Q-798: Explain the project exports

A-798: To export of engineering goods on deferred payment terms and execution of turnkey

projects and civil construction contracts abroad collectively.

Project Exports would encompass

(i) Civil construction contracts;

(ii) Turnkey Engineering contracts including supply of Capital Goods on deferred

payment terms;

(iii) Process and Engineering Consultancy Services; and

(iv) Project Construction items (excluding Steel and Cement).

RE-EXPORT/RE-IMPORT

Q-799: State true or false:

(i) Re-export under Section 69 & 74 of the Customs Act, 1962

(ii) Re-export of goods imported under Reward Scheme as specified under Chapter 4 of

the Foreign Trade Policy

(iii) Re-export under Section 69 of the Customs Act, 1962 filed through online under

Scheme Code 00.

(iv) Re-export under Section 74 of the Customs Act, 1962 filed through online under

Scheme Code 19.

(v) Re-export of goods imported under Reward Scheme as specified under Chapter 3 of

the Foreign Trade Policy filed though online under Scheme Code 00

199