Page 232 - COMBINED QUESTIONS AND ANSWERS - EDITION 2019 - PART II_Neat

P. 232

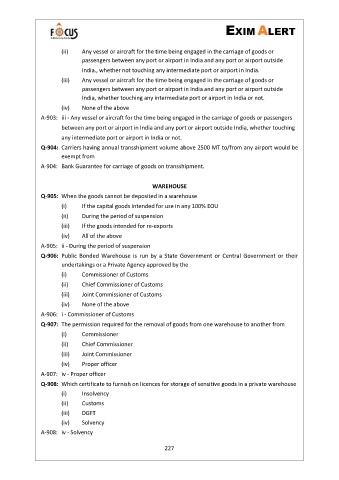

(ii) Any vessel or aircraft for the time being engaged in the carriage of goods or

passengers between any port or airport in India and any port or airport outside

India., whether not touching any intermediate port or airport in India.

(iii) Any vessel or aircraft for the time being engaged in the carriage of goods or

passengers between any port or airport in India and any port or airport outside

India, whether touching any intermediate port or airport in India or not.

(iv) None of the above

A-903: iii - Any vessel or aircraft for the time being engaged in the carriage of goods or passengers

between any port or airport in India and any port or airport outside India, whether touching

any intermediate port or airport in India or not.

Q-904: Carriers having annual transshipment volume above 2500 MT to/from any airport would be

exempt from

A-904: Bank Guarantee for carriage of goods on transshipment.

WAREHOUSE

Q-905: When the goods cannot be deposited in a warehouse

(i) If the capital goods intended for use in any 100% EOU

(ii) During the period of suspension

(iii) If the goods intended for re-exports

(iv) All of the above

A-905: ii - During the period of suspension

Q-906: Public Bonded Warehouse is run by a State Government or Central Government or their

undertakings or a Private Agency approved by the

(i) Commissioner of Customs

(ii) Chief Commissioner of Customs

(iii) Joint Commissioner of Customs

(iv) None of the above

A-906: i - Commissioner of Customs

Q-907: The permission required for the removal of goods from one warehouse to another from

(i) Commissioner

(ii) Chief Commissioner

(iii) Joint Commissioner

(iv) Proper officer

A-907: iv - Proper officer

Q-908: Which certificate to furnish on licences for storage of sensitive goods in a private warehouse

(i) Insolvency

(ii) Customs

(iii) DGFT

(iv) Solvency

A-908: iv - Solvency

227