Page 58 - demo

P. 58

4 INDIAN SCENARIO

he current consumption of methanol in India is primarily for the manufacture of chemicals

such as acetic acid. Usage as fuel or fuel additives is not prevalent. Currently, India

Timports a large amount of methanol.

4.1 Current Methanol Production Capacity and Economics

Current methanol consumption in India is 1.5 MTPA. The demand is growing at about 10%

and is expected to continue to be met through imports. The current production and imports are

shown in Table 12.

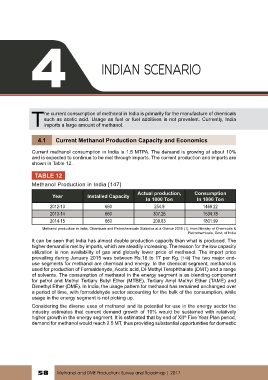

TABLE 12

Methanol Production in India [147]

Actual production, Consumption

Year Installed Capacity

In 1000 Ton In 1000 Ton

2012-13 660 254.9 1469.22

2013-14 660 307.26 1534.78

2014-15 660 209.83 1801.99

Methanol production in India, Chemicals and Petrochemicals Statistics at a Glance 2015 (1), from Ministry of Chemicals &

Petrochemicals, Govt. of India

It can be seen that India has almost double production capacity than what is produced. The

higher demand is met by imports, which are steadily increasing. The reason for the low capacity

utilization is non availability of gas and globally lower price of methanol. The import price

prevailing during January 2015 was between Rs.16 to 17 per Kg. [148] The two major end-

use segments for methanol are chemical and energy. In the chemical segment, methanol is

used for production of Formaldehyde, Acetic acid, Di-Methyl Terephthalate (DMT) and a range

of solvents. The consumption of methanol in the energy segment is as blending component

for petrol and Methyl Tertiary Butyl Ether (MTBE), Tertiary Amyl Methyl Ether (TAME) and

Dimethyl Ether (DME). In India, the usage pattern for methanol has remained unchanged over

a period of time, with formaldehyde sector accounting for the bulk of the consumption, while

usage in the energy segment is not picking up.

Considering the diverse uses of methanol and its potential for use in the energy sector the

industry estimates that current demand growth of 10% would be sustained with relatively

higher growth in the energy segment. It is estimated that by end of XII Five Year Plan period,

th

demand for methanol would reach 2.5 MT, thus providing substantial opportunities for domestic

58 Methanol and DME Production: Survey and Roadmap | 2017