Page 107 - A Canuck's Guide to Financial Literacy 2020

P. 107

107

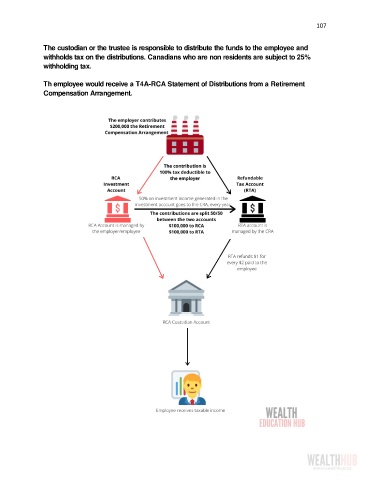

The custodian or the trustee is responsible to distribute the funds to the employee and

withholds tax on the distributions. Canadians who are non residents are subject to 25%

withholding tax.

Th employee would receive a T4A-RCA Statement of Distributions from a Retirement

Compensation Arrangement.