Page 109 - A Canuck's Guide to Financial Literacy 2020

P. 109

109

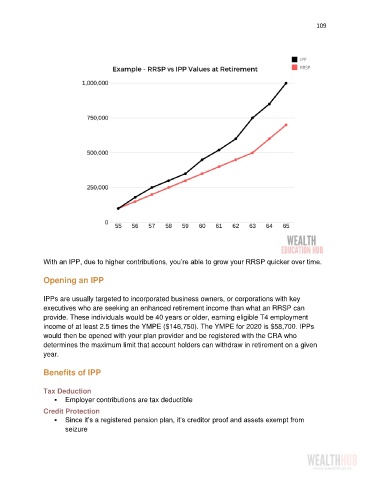

With an IPP, due to higher contributions, you’re able to grow your RRSP quicker over time.

Opening an IPP

IPPs are usually targeted to incorporated business owners, or corporations with key

executives who are seeking an enhanced retirement income than what an RRSP can

provide. These individuals would be 40 years or older, earning eligible T4 employment

income of at least 2.5 times the YMPE ($146,750). The YMPE for 2020 is $58,700. IPPs

would then be opened with your plan provider and be registered with the CRA who

determines the maximum limit that account holders can withdraw in retirement on a given

year.

Benefits of IPP

Tax Deduction

▪ Employer contributions are tax deductible

Credit Protection

▪ Since it’s a registered pension plan, it’s creditor proof and assets exempt from

seizure