Page 114 - A Canuck's Guide to Financial Literacy 2020

P. 114

114

• Max Pension: To receive the max pension, you'd have to contribute at least 83% of

the time. 83% of 47 is 39 years. You must contribute to the plan for 39 years and the

contribution should be sufficient.

• Yearly Maximum Pensionable Earnings (YMPE): CPP uses something called the

YMPE to assess whether you contributed enough. To summarize, if your income

was less than $58,700 in 2020 then you have not contributed enough to the CPP to

qualify for the maximum pension within that 39 year period. If your earnings was

higher than $58,700 for 2020, you'll notice towards the end of the year, your pay is a

bit higher as you've reached the maximum CPP contribution for the year.

o The YMPE is adjusted annually to reflect changes in the average wages and

salaries.

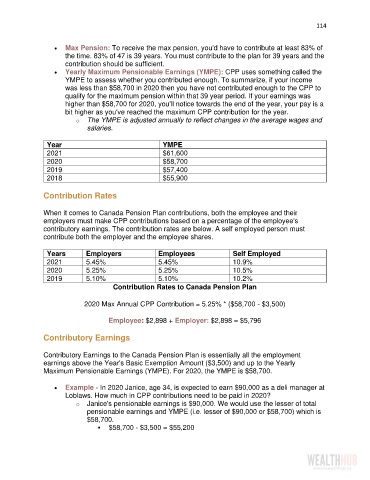

Year YMPE

2021 $61,600

2020 $58,700

2019 $57,400

2018 $55,900

Contribution Rates

When it comes to Canada Pension Plan contributions, both the employee and their

employers must make CPP contributions based on a percentage of the employee's

contributory earnings. The contribution rates are below. A self employed person must

contribute both the employer and the employee shares.

Years Employers Employees Self Employed

2021 5.45% 5.45% 10.9%

2020 5.25% 5.25% 10.5%

2019 5.10% 5.10% 10.2%

Contribution Rates to Canada Pension Plan

2020 Max Annual CPP Contribution = 5.25% * ($58,700 - $3,500)

Employee: $2,898 + Employer: $2,898 = $5,796

Contributory Earnings

Contributory Earnings to the Canada Pension Plan is essentially all the employment

earnings above the Year's Basic Exemption Amount ($3,500) and up to the Yearly

Maximum Pensionable Earnings (YMPE). For 2020, the YMPE is $58,700.

• Example - In 2020 Janice, age 34, is expected to earn $90,000 as a deli manager at

Loblaws. How much in CPP contributions need to be paid in 2020?

o Janice's pensionable earnings is $90,000. We would use the lesser of total

pensionable earnings and YMPE (i.e. lesser of $90,000 or $58,700) which is

$58,700.

▪ $58,700 - $3,500 = $55,200