Page 126 - A Canuck's Guide to Financial Literacy 2020

P. 126

126

Non-Residents

Non Resident seniors who receive OAS payments must submit an Old Age Security Return

of Income (OASRI) so that the CRA can determine if you have to pay a clawback and in

order to ensure that your OAS payments are not cut off.

o If you reside in a country that has a tax treaty with Canada, you may be

exempt from filing this form.

Clawback Rate

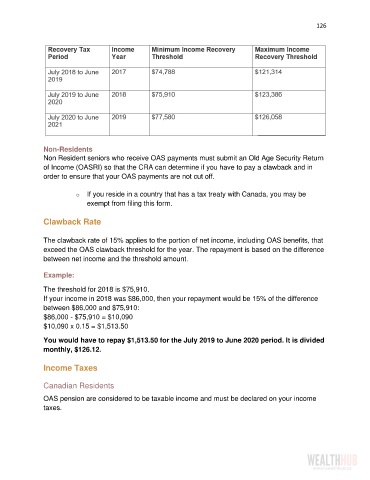

The clawback rate of 15% applies to the portion of net income, including OAS benefits, that

exceed the OAS clawback threshold for the year. The repayment is based on the difference

between net income and the threshold amount.

Example:

The threshold for 2018 is $75,910.

If your income in 2018 was $86,000, then your repayment would be 15% of the difference

between $86,000 and $75,910:

$86,000 - $75,910 = $10,090

$10,090 x 0.15 = $1,513.50

You would have to repay $1,513.50 for the July 2019 to June 2020 period. It is divided

monthly, $126.12.

Income Taxes

Canadian Residents

OAS pension are considered to be taxable income and must be declared on your income

taxes.