Page 128 - A Canuck's Guide to Financial Literacy 2020

P. 128

128

Guaranteed Income Supplement

Low income Canadians who qualify to receive Old Age Security are eligible to receive a

monthly non-taxable benefit known as Guaranteed Income Supplement or GIS.

Eligibility

For an individual to qualify for GIS, they must meet the criteria below:

• They're receiving Old Age Security (65+) and

• Their annual income (or in the case of a couple, their combined income) is lower

than the maximum annual threshold.

Amount of Benefits

• The amount of income an individual could receive depends on their marital status

and income.

• If the applicant is married or living in a common law relationship, the combined

income of both spouses/common law partner must be taken into account

• Your net income (excluding OAS and GIS income) for the previous calendar year is

used to determine benefit amounts

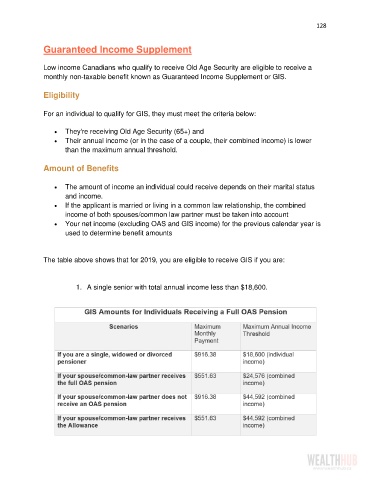

The table above shows that for 2019, you are eligible to receive GIS if you are:

1. A single senior with total annual income less than $18,600.