Page 133 - A Canuck's Guide to Financial Literacy 2020

P. 133

133

Defined Benefit Plans

Registered Pensions Plans also known as Employer Pension Plans are set up on behalf of

employees or a union in order to provide periodic payments in retirement. These plans are

registered with the CRA and appropriate federal and provincial regulatory

authorities. These regulatory authorities define the minimum standard of benefit that must

be provided by an RPP to the plan members. There are two types of employer pension

plans:

• Defined Benefit Plan

• Defined Contribution Plans

Defined-benefit pension plans, also known as DB plans, are the preferred choice for unions

and employees as they promise a guaranteed monthly pension income in retirement. These

types of plans are slowly being phased out as the plan sponsor assumes all the risk in

making sure that this guaranteed monthly income in retirement is achieved.

Amount of Benefits

The benefit that plan members could receive in retirement is determined by a formula that

considers several factors such as length of employment and salary history. Companies and

plan sponsors have different type of formulas that they follow but below are three common

formulas.

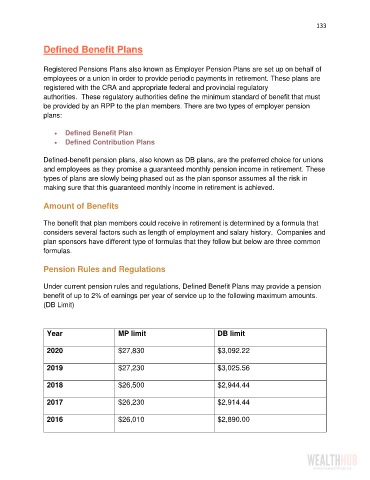

Pension Rules and Regulations

Under current pension rules and regulations, Defined Benefit Plans may provide a pension

benefit of up to 2% of earnings per year of service up to the following maximum amounts.

(DB Limit)

Year MP limit DB limit

2020 $27,830 $3,092.22

2019 $27,230 $3,025.56

2018 $26,500 $2,944.44

2017 $26,230 $2,914.44

2016 $26,010 $2,890.00