Page 139 - A Canuck's Guide to Financial Literacy 2020

P. 139

139

Defined Contribution Plans

In a Defined Contribution Plan, also called "Money Purchase Plan", the final retirement

benefit is not known. A plan member would know how much they're putting in the plan but

don't know how much they'll be taking out in retirement. The final amount depends

on several factors mentioned below

o Salary or wage levels and the resulting contributions made

o Investment selection

o Investment return

o Annuity and/or interest rates at the time the plan member retires

Amount of Contributions

The employee and the employer contributions into a DC plan are usually determined as a

percentage of earnings/salary. The total employee, employer, and voluntary

contributions cannot exceed the lesser of the following amounts:

▪ 18% of the employee's salary determined under the plan

or

▪ The MP limit for the year as determined by Income Tax Act

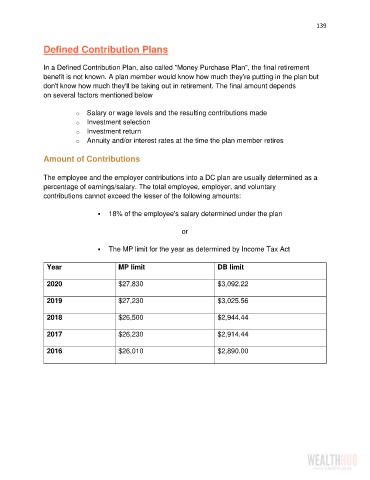

Year MP limit DB limit

2020 $27,830 $3,092.22

2019 $27,230 $3,025.56

2018 $26,500 $2,944.44

2017 $26,230 $2,914.44

2016 $26,010 $2,890.00