Page 15 - A Canuck's Guide to Financial Literacy 2020

P. 15

15

The Different Risk Profiles

Equities

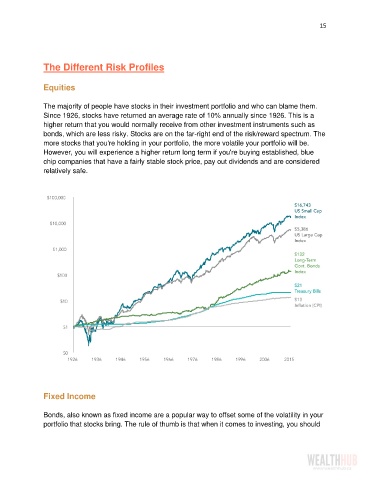

The majority of people have stocks in their investment portfolio and who can blame them.

Since 1926, stocks have returned an average rate of 10% annually since 1926. This is a

higher return that you would normally receive from other investment instruments such as

bonds, which are less risky. Stocks are on the far-right end of the risk/reward spectrum. The

more stocks that you're holding in your portfolio, the more volatile your portfolio will be.

However, you will experience a higher return long term if you're buying established, blue

chip companies that have a fairly stable stock price, pay out dividends and are considered

relatively safe.

Fixed Income

Bonds, also known as fixed income are a popular way to offset some of the volatility in your

portfolio that stocks bring. The rule of thumb is that when it comes to investing, you should