Page 182 - A Canuck's Guide to Financial Literacy 2020

P. 182

182

Dividends

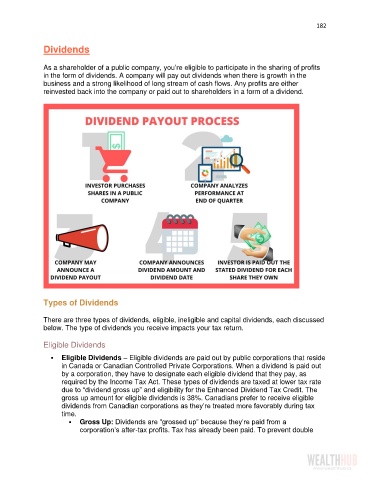

As a shareholder of a public company, you’re eligible to participate in the sharing of profits

in the form of dividends. A company will pay out dividends when there is growth in the

business and a strong likelihood of long stream of cash flows. Any profits are either

reinvested back into the company or paid out to shareholders in a form of a dividend.

Types of Dividends

There are three types of dividends, eligible, ineligible and capital dividends, each discussed

below. The type of dividends you receive impacts your tax return.

Eligible Dividends

▪ Eligible Dividends – Eligible dividends are paid out by public corporations that reside

in Canada or Canadian Controlled Private Corporations. When a dividend is paid out

by a corporation, they have to designate each eligible dividend that they pay, as

required by the Income Tax Act. These types of dividends are taxed at lower tax rate

due to “dividend gross up” and eligibility for the Enhanced Dividend Tax Credit. The

gross up amount for eligible dividends is 38%. Canadians prefer to receive eligible

dividends from Canadian corporations as they’re treated more favorably during tax

time.

▪ Gross Up: Dividends are “grossed up” because they’re paid from a

corporation’s after-tax profits. Tax has already been paid. To prevent double