Page 184 - A Canuck's Guide to Financial Literacy 2020

P. 184

184

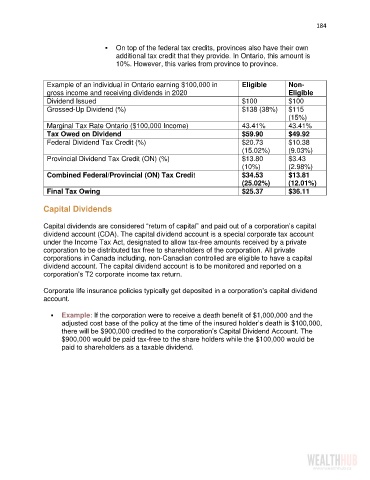

▪ On top of the federal tax credits, provinces also have their own

additional tax credit that they provide. In Ontario, this amount is

10%. However, this varies from province to province.

Example of an individual in Ontario earning $100,000 in Eligible Non-

gross income and receiving dividends in 2020 Eligible

Dividend Issued $100 $100

Grossed-Up Dividend (%) $138 (38%) $115

(15%)

Marginal Tax Rate Ontario ($100,000 Income) 43.41% 43.41%

Tax Owed on Dividend $59.90 $49.92

Federal Dividend Tax Credit (%) $20.73 $10.38

(15.02%) (9.03%)

Provincial Dividend Tax Credit (ON) (%) $13.80 $3.43

(10%) (2.98%)

Combined Federal/Provincial (ON) Tax Credit $34.53 $13.81

(25.02%) (12.01%)

Final Tax Owing $25.37 $36.11

Capital Dividends

Capital dividends are considered “return of capital” and paid out of a corporation’s capital

dividend account (CDA). The capital dividend account is a special corporate tax account

under the Income Tax Act, designated to allow tax-free amounts received by a private

corporation to be distributed tax free to shareholders of the corporation. All private

corporations in Canada including, non-Canadian controlled are eligible to have a capital

dividend account. The capital dividend account is to be monitored and reported on a

corporation’s T2 corporate income tax return.

Corporate life insurance policies typically get deposited in a corporation’s capital dividend

account.

▪ Example: If the corporation were to receive a death benefit of $1,000,000 and the

adjusted cost base of the policy at the time of the insured holder’s death is $100,000,

there will be $900,000 credited to the corporation’s Capital Dividend Account. The

$900,000 would be paid tax-free to the share holders while the $100,000 would be

paid to shareholders as a taxable dividend.