Page 189 - A Canuck's Guide to Financial Literacy 2020

P. 189

189

Exchange Traded Funds

Exchange Traded Funds (ETFs) are an investment solution structured similar to a mutual

fund that are listed on the stock market. These ETFs are attractive to investors due to their

low cost, tax efficiency and stock like features. ETFs are able to invest in various asset

classes such as stocks, bonds, currencies, commodities and more. One of the most popular

ETFs is the SPDR S&P 500 ETF (SPY) that tracks the S&P 500 index.

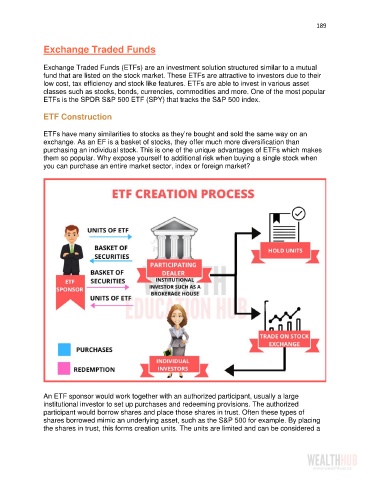

ETF Construction

ETFs have many similarities to stocks as they’re bought and sold the same way on an

exchange. As an EF is a basket of stocks, they offer much more diversification than

purchasing an individual stock. This is one of the unique advantages of ETFs which makes

them so popular. Why expose yourself to additional risk when buying a single stock when

you can purchase an entire market sector, index or foreign market?

An ETF sponsor would work together with an authorized participant, usually a large

institutional investor to set up purchases and redeeming provisions. The authorized

participant would borrow shares and place those shares in trust. Often these types of

shares borrowed mimic an underlying asset, such as the S&P 500 for example. By placing

the shares in trust, this forms creation units. The units are limited and can be considered a