Page 190 - A Canuck's Guide to Financial Literacy 2020

P. 190

190

legal claim on the shares held in trust. Once these units are in hand of the authorized

participant, they’re sold in the public market similar to stocks.

Types of ETFs

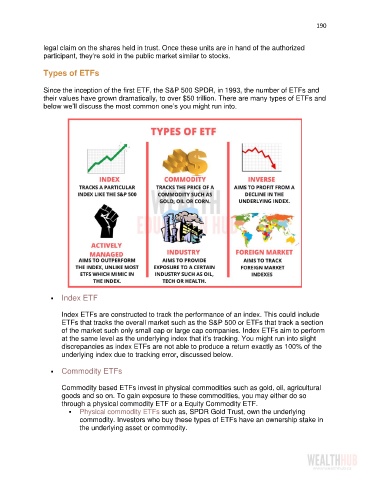

Since the inception of the first ETF, the S&P 500 SPDR, in 1993, the number of ETFs and

their values have grown dramatically, to over $50 trillion. There are many types of ETFs and

below we’ll discuss the most common one’s you might run into.

▪ Index ETF

Index ETFs are constructed to track the performance of an index. This could include

ETFs that tracks the overall market such as the S&P 500 or ETFs that track a section

of the market such only small cap or large cap companies. Index ETFs aim to perform

at the same level as the underlying index that it’s tracking. You might run into slight

discrepancies as index ETFs are not able to produce a return exactly as 100% of the

underlying index due to tracking error, discussed below.

▪ Commodity ETFs

Commodity based ETFs invest in physical commodities such as gold, oil, agricultural

goods and so on. To gain exposure to these commodities, you may either do so

through a physical commodity ETF or a Equity Commodity ETF.

▪ Physical commodity ETFs such as, SPDR Gold Trust, own the underlying

commodity. Investors who buy these types of ETFs have an ownership stake in

the underlying asset or commodity.