Page 68 - A Canuck's Guide to Financial Literacy 2020

P. 68

68

Beneficiaries qualify for a grant on the contributions made on their behalf before the end of

the calendar year in which they turn 17 years of age.

Keep in mind that there are specific contribution requirement rules for children who are 16

or 17 years old. In order for children in that age group to receive government grant, they

must have met one of the following:

• a minimum of $2,000 contribution has been made, to and not withdrawn from,

RESPs in respect of the beneficiary before the year in which the beneficiary turns 16

• a minimum of $100 annual contributions has been made and not withdrawn from,

RESPs in any of the last 4 years

Additional CESG

ESDC will contribute an additional amount of grant for each qualifying beneficiary

depending on your family income.

For 2017, the additional CESG rate on the first $500 contributed to an RESP for a

beneficiary who is a child under 18 years of age is:

• 40% (extra 20% on the first $500), if the child's family has qualifying net income for

the year of $45,916 or less; or

• 30% (extra 10% on the first $500), if the child's family has qualifying net income for

the year that is more than $45,916 but is less than $91,831.

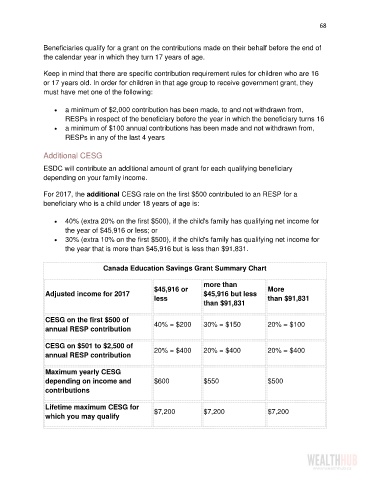

Canada Education Savings Grant Summary Chart

more than

$45,916 or More

Adjusted income for 2017 $45,916 but less

less than $91,831

than $91,831

CESG on the first $500 of 40% = $200 30% = $150 20% = $100

annual RESP contribution

CESG on $501 to $2,500 of 20% = $400 20% = $400 20% = $400

annual RESP contribution

Maximum yearly CESG

depending on income and $600 $550 $500

contributions

Lifetime maximum CESG for $7,200 $7,200 $7,200

which you may qualify