Page 73 - A Canuck's Guide to Financial Literacy 2020

P. 73

73

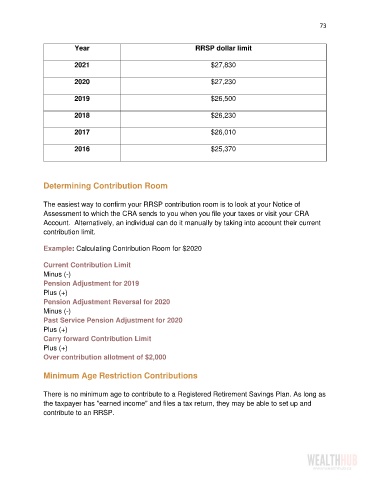

Year RRSP dollar limit

2021 $27,830

2020 $27,230

2019 $26,500

2018 $26,230

2017 $26,010

2016 $25,370

Determining Contribution Room

The easiest way to confirm your RRSP contribution room is to look at your Notice of

Assessment to which the CRA sends to you when you file your taxes or visit your CRA

Account. Alternatively, an individual can do it manually by taking into account their current

contribution limit.

Example: Calculating Contribution Room for $2020

Current Contribution Limit

Minus (-)

Pension Adjustment for 2019

Plus (+)

Pension Adjustment Reversal for 2020

Minus (-)

Past Service Pension Adjustment for 2020

Plus (+)

Carry forward Contribution Limit

Plus (+)

Over contribution allotment of $2,000

Minimum Age Restriction Contributions

There is no minimum age to contribute to a Registered Retirement Savings Plan. As long as

the taxpayer has "earned income" and files a tax return, they may be able to set up and

contribute to an RRSP.