Page 78 - A Canuck's Guide to Financial Literacy 2020

P. 78

78

Registered Retirement Income Fund

At the end of the year you turn 71, your RRSP matures and you must convert it to a

Registered Retirement Income Fund, an annuity or withdraw it as a lump sum. The gist of a

Registered Retirement Income Fund is to provide you with a regular stream of income as a

minimum percentage must be withdrawn each year.

Converting RRSP to RRIF

Consider a RRIF as an extension of your RRSP. The funds inside the RRIF can continue to

grow tax deferred, until withdrawn, and you can still keep the same portfolio holdings. One

of the major differences, however, is that once your RRSP is converted into a RRIF, you

cannot deposit any more funds into it. You can only withdraw. You can withdraw any

amount of the RRIF as long as the mandatory minimum withdrawal is met each year.

Converting Your RRSP to a RRIF Before Age 71

There is no age requirement in which you can convert your RRSP into a RRIF. There is no

benefit of converting your RRSP into a RRIF before age 65 unless you’re looking on

withdrawing income. At age 65, you can do a partial conversion of your RRSP into a RRIF

and take advantage of pension income tax credit and pension income splitting with your

spouse.

Mandatory Minimum Withdrawal

Minimum withdrawal payments are not required to begin until the following year in which the

RRIF account was opened, meaning that your first withdrawal must be completed by

December 31st of the year you turn 72.

How Much Do I Withdraw?

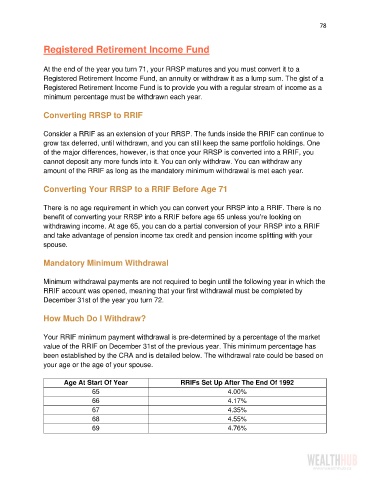

Your RRIF minimum payment withdrawal is pre-determined by a percentage of the market

value of the RRIF on December 31st of the previous year. This minimum percentage has

been established by the CRA and is detailed below. The withdrawal rate could be based on

your age or the age of your spouse.

Age At Start Of Year RRIFs Set Up After The End Of 1992

65 4.00%

66 4.17%

67 4.35%

68 4.55%

69 4.76%