Page 80 - A Canuck's Guide to Financial Literacy 2020

P. 80

80

Frequency of RRIF Payments

One of the decisions individuals have to make is how frequent they wish to have the

minimum RRIF payment sent to them. The options are:

▪ Monthly

▪ Quarterly

▪ Semi-Annually

▪ Annually

Each individuals’ circumstances are unique and you would choose a frequency that would

meet your needs.

What If You Don’t Need the Income?

If you aren’t in need of the income that a RRIF provides, you can do an in-kind withdrawal to

your Non Registered Cash Account or TFSA. For example, say you’re holding 50 shares of

RBC in your RRIF and you don’t wish to sell them to cover your RRIF payment. You can

transfer these 50 shares in-kind to your Non-Registered Account or TFSA, as part of the

minimum withdrawal. Your shares stay invested and you’ve satisfied the requirement of

withdrawing the minimum from your RRIF.

Taxation of RRIF Withdrawals

If you’re withdrawing the minimum from the RRIF each year, there is no tax withheld at the

source. However, all withdrawals are fully taxable and must be declared. Your institution will

issue your a T4-RIF detailing the withdrawal amount and any taxes withheld.

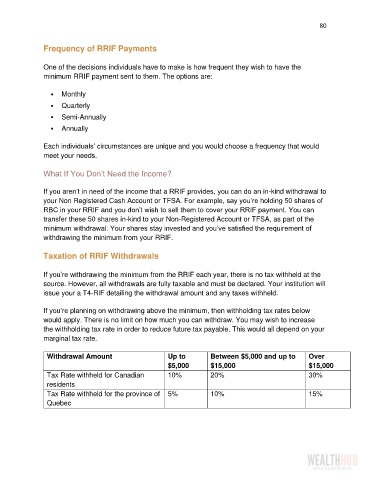

If you’re planning on withdrawing above the minimum, then withholding tax rates below

would apply. There is no limit on how much you can withdraw. You may wish to increase

the withholding tax rate in order to reduce future tax payable. This would all depend on your

marginal tax rate.

Withdrawal Amount Up to Between $5,000 and up to Over

$5,000 $15,000 $15,000

Tax Rate withheld for Canadian 10% 20% 30%

residents

Tax Rate withheld for the province of 5% 10% 15%

Quebec