Page 77 - A Canuck's Guide to Financial Literacy 2020

P. 77

77

Repayment of Withdrawals

The repayment period is 10 years or when the LLP participant leaves the

educational program. The payment periods start no later than 60 days following the

fifth year after the first LLP withdrawal.

The repayment period could start sooner if the LLP participant fails to qualify for a

full-time education for at least 3 consecutive months within 2 years of the 5 year

period. Repayment will start within 60 days following the second year.

Any amount that is not repaid is added on top of income.

Keep in mind that the repayment period could be shorter than 10 years if;

• If the participant dies

• If the participant becomes a non resident

• If the participant reaches 72 years of age or older

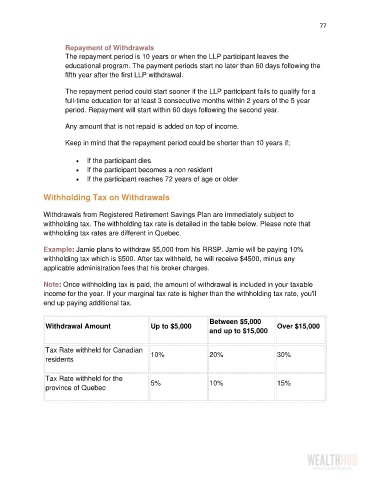

Withholding Tax on Withdrawals

Withdrawals from Registered Retirement Savings Plan are immediately subject to

withholding tax. The withholding tax rate is detailed in the table below. Please note that

withholding tax rates are different in Quebec.

Example: Jamie plans to withdraw $5,000 from his RRSP. Jamie will be paying 10%

withholding tax which is $500. After tax withheld, he will receive $4500, minus any

applicable administration fees that his broker charges.

Note: Once withholding tax is paid, the amount of withdrawal is included in your taxable

income for the year. If your marginal tax rate is higher than the withholding tax rate, you'll

end up paying additional tax.

Between $5,000

Withdrawal Amount Up to $5,000 Over $15,000

and up to $15,000

Tax Rate withheld for Canadian 10% 20% 30%

residents

Tax Rate withheld for the 5% 10% 15%

province of Quebec