Page 84 - A Canuck's Guide to Financial Literacy 2020

P. 84

84

Tax Free Savings Account

Tax Free Savings Account or 'TFSA' is an investment vehicle that allows Canadians who

are 18 years of age or older to invest money tax-free. Any investment income, capital gains

or other earnings are not subject to tax. The program started in 2009 with a $5,000 limit and

over the years, the limit has increased each year. As of 2020, the limit is $69,500.

Opening a Tax-Free Savings Account

Canadians who are 18 years of age or older with a valid social insurance number (SIN)

are allowed to open a TFSA. Once a individual reaches 18 years of age, they're eligible to

contribute up to the full TFSA dollar limit for that particular year.

Contributing into Tax-Free Savings Account

Contributing into a Tax-Free Savings Account is limited by your contribution room. Each

year, you would accumulate TFSA contribution room even if you do not file a tax return. The

contribution room depends on the annual TFSA dollar limit for the year.

Example: Jeff is 53 years old. Since 2009, he has earned a TFSA contribution limit of

$69,500. Jeff may contribute up to $69,500 into his Tax-Free Savings Account.

The goal of the TFSA annual limit is to be indexed to inflation and rounded to the nearest

$500.

Tip: You are not required to have earned income as you would in an RRSP to contribute

into a TFSA. Unlike RRSP contributions, TFSA contributions are not tax deductible.

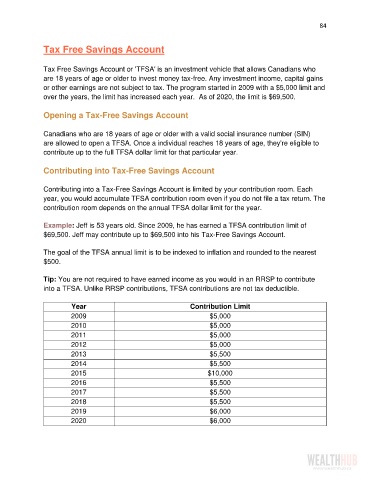

Year Contribution Limit

2009 $5,000

2010 $5,000

2011 $5,000

2012 $5,000

2013 $5,500

2014 $5,500

2015 $10,000

2016 $5,500

2017 $5,500

2018 $5,500

2019 $6,000

2020 $6,000