Page 90 - A Canuck's Guide to Financial Literacy 2020

P. 90

90

Withdrawing in Retirement

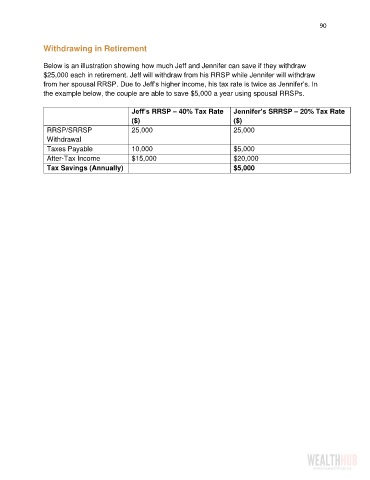

Below is an illustration showing how much Jeff and Jennifer can save if they withdraw

$25,000 each in retirement. Jeff will withdraw from his RRSP while Jennifer will withdraw

from her spousal RRSP. Due to Jeff’s higher income, his tax rate is twice as Jennifer’s. In

the example below, the couple are able to save $5,000 a year using spousal RRSPs.

Jeff’s RRSP – 40% Tax Rate Jennifer’s SRRSP – 20% Tax Rate

($) ($)

RRSP/SRRSP 25,000 25,000

Withdrawal

Taxes Payable 10,000 $5,000

After-Tax Income $15,000 $20,000

Tax Savings (Annually) $5,000