Page 94 - A Canuck's Guide to Financial Literacy 2020

P. 94

94

the maximum withdrawal. CANSIM stands for Canadian Socio-Economic Information

Management. According to Government of Canada, the CANSIM rate is set monthly and is

based on that month’s average rate for long term Government of Canada bonds. To

determine your maximum withdrawal rate, it’s advisable to contact your financial institution.

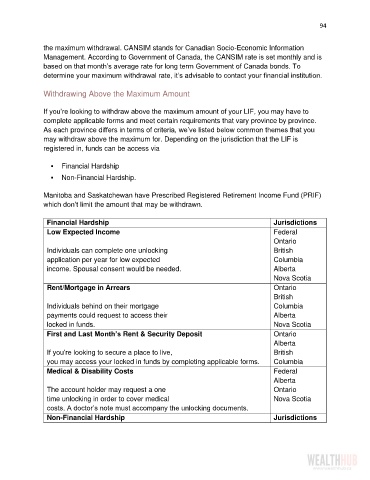

Withdrawing Above the Maximum Amount

If you’re looking to withdraw above the maximum amount of your LIF, you may have to

complete applicable forms and meet certain requirements that vary province by province.

As each province differs in terms of criteria, we’ve listed below common themes that you

may withdraw above the maximum for. Depending on the jurisdiction that the LIF is

registered in, funds can be access via

▪ Financial Hardship

▪ Non-Financial Hardship.

Manitoba and Saskatchewan have Prescribed Registered Retirement Income Fund (PRIF)

which don’t limit the amount that may be withdrawn.

Financial Hardship Jurisdictions

Low Expected Income Federal

Ontario

Individuals can complete one unlocking British

application per year for low expected Columbia

income. Spousal consent would be needed. Alberta

Nova Scotia

Rent/Mortgage in Arrears Ontario

British

Individuals behind on their mortgage Columbia

payments could request to access their Alberta

locked in funds. Nova Scotia

First and Last Month’s Rent & Security Deposit Ontario

Alberta

If you’re looking to secure a place to live, British

you may access your locked in funds by completing applicable forms. Columbia

Medical & Disability Costs Federal

Alberta

The account holder may request a one Ontario

time unlocking in order to cover medical Nova Scotia

costs. A doctor’s note must accompany the unlocking documents.

Non-Financial Hardship Jurisdictions