Page 99 - A Canuck's Guide to Financial Literacy 2020

P. 99

99

4. Submit your pension package along with the LIRA/LRSP account number to your

former company

5. The former company would proceed to move the accumulated pension funds to your

LIRA/LRSP

6. Start investing the funds in a portfolio that is in accordance with your risk appetite and

risk tolerance.

Similar to RRSPs, funds in LIRAs are able to accumulate tax deferred until withdrawn. In

most provinces, LIRA account holders can start withdrawing regular income as early as 55.

Creditor Protection

When you open a LIRA, you can be comfortable of the thought that they can’t be accessed

by creditors, however, keep in mind that under certain circumstances such as marriage

breakdown, LIRAs may have to be split with your spouse or common law partner.

Naming a Beneficiary

The beneficiary can be your spouse, common law partner, estate or another individual. If

you wish to name a beneficiary someone other than your spouse or common law partner,

your spouse/common law partner must complete a waiver and give up their right to your

locked-in funds. If you don’t have a spouse, then you can designate a beneficiary of your

choosing.

Withdrawing from your LIRA

If you’re looking to withdraw from your LIRA, you must complete applicable forms and meet

certain requirements that vary province by province. As each province differs in terms of

criteria, we’ve listed below common themes that you may withdraw for. Depending on the

jurisdiction that the LIRA is subject to, funds can be accessed via

▪ Financial Hardship or

▪ Non-Financial Hardship

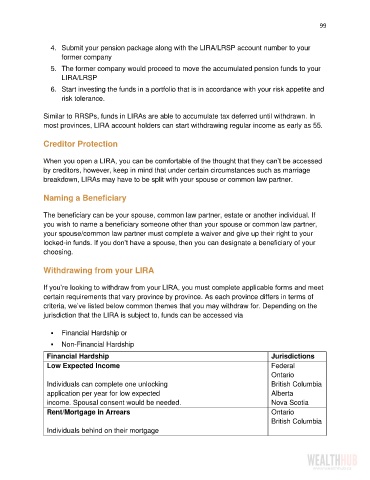

Financial Hardship Jurisdictions

Low Expected Income Federal

Ontario

Individuals can complete one unlocking British Columbia

application per year for low expected Alberta

income. Spousal consent would be needed. Nova Scotia

Rent/Mortgage in Arrears Ontario

British Columbia

Individuals behind on their mortgage