Page 101 - A Canuck's Guide to Financial Literacy 2020

P. 101

101

you may unlock your funds pending that Quebec

you’ve received a confirmation letter from the CRA. Manitoba

Saskatchewan

Nova Scotia

Be mindful that in order to unlock the account, applicable forms and spousal consent may

have to be provided.

Tax on Withdrawals

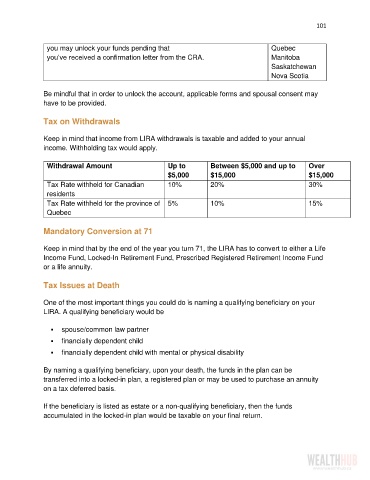

Keep in mind that income from LIRA withdrawals is taxable and added to your annual

income. Withholding tax would apply.

Withdrawal Amount Up to Between $5,000 and up to Over

$5,000 $15,000 $15,000

Tax Rate withheld for Canadian 10% 20% 30%

residents

Tax Rate withheld for the province of 5% 10% 15%

Quebec

Mandatory Conversion at 71

Keep in mind that by the end of the year you turn 71, the LIRA has to convert to either a Life

Income Fund, Locked-In Retirement Fund, Prescribed Registered Retirement Income Fund

or a life annuity.

Tax Issues at Death

One of the most important things you could do is naming a qualifying beneficiary on your

LIRA. A qualifying beneficiary would be

▪ spouse/common law partner

▪ financially dependent child

▪ financially dependent child with mental or physical disability

By naming a qualifying beneficiary, upon your death, the funds in the plan can be

transferred into a locked-in plan, a registered plan or may be used to purchase an annuity

on a tax deferred basis.

If the beneficiary is listed as estate or a non-qualifying beneficiary, then the funds

accumulated in the locked-in plan would be taxable on your final return.