Page 96 - A Canuck's Guide to Financial Literacy 2020

P. 96

96

If you’re thinking about accessing your funds in your LIF, contact your financial advisor for

help to determine what jurisdiction your LIF falls under and what are your options are.

Tax on Withdrawals

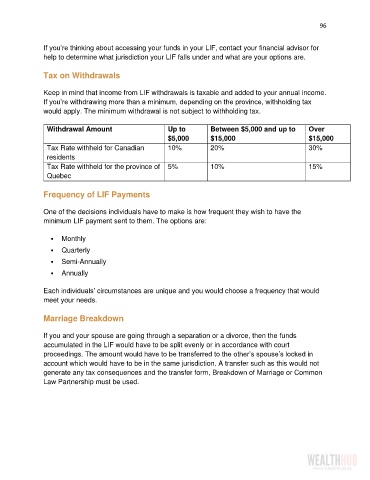

Keep in mind that income from LIF withdrawals is taxable and added to your annual income.

If you’re withdrawing more than a minimum, depending on the province, withholding tax

would apply. The minimum withdrawal is not subject to withholding tax.

Withdrawal Amount Up to Between $5,000 and up to Over

$5,000 $15,000 $15,000

Tax Rate withheld for Canadian 10% 20% 30%

residents

Tax Rate withheld for the province of 5% 10% 15%

Quebec

Frequency of LIF Payments

One of the decisions individuals have to make is how frequent they wish to have the

minimum LIF payment sent to them. The options are:

▪ Monthly

▪ Quarterly

▪ Semi-Annually

▪ Annually

Each individuals’ circumstances are unique and you would choose a frequency that would

meet your needs.

Marriage Breakdown

If you and your spouse are going through a separation or a divorce, then the funds

accumulated in the LIF would have to be split evenly or in accordance with court

proceedings. The amount would have to be transferred to the other’s spouse’s locked in

account which would have to be in the same jurisdiction. A transfer such as this would not

generate any tax consequences and the transfer form, Breakdown of Marriage or Common

Law Partnership must be used.