Page 31 - Fiscal 2022 Impact Report

P. 31

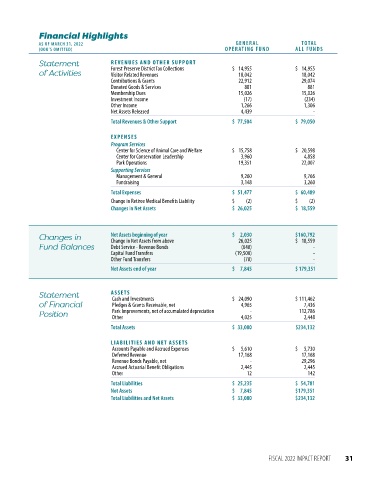

Financial Highlights

AS OF MARCH 31, 2022 GENERAL TOTAL

(OOO’S OMITTED) OPERATING FUND ALL FUNDS

a

t

em

t

S

Statement REVENUES AND OTHER SUPPORT

en

t

o f A c ti v i ti e s Forest Preserve District Tax Collections $ 14,955 $ 14,955

of Activities

18,042

18,042

Visitor Related Revenues

Contributions & Grants 22,912 29,074

Donated Goods & Services 881 881

Membership Dues 15,026 15,026

Investment Income (17) (234)

Other Income 1,266 1,306

Net Assets Released 4,439 -

Total Revenues & Other Support $ 77,504 $ 79,050

EXPENSES

Program Services

Center for Science of Animal Care and Welfare $ 15,758 $ 20,598

Center for Conservation Leadership 3,960 4,858

Park Operations 19,351 22,007

Supporting Services

Management & General 9,260 9,766

Fundraising 3,148 3,260

Total Expenses $ 51,477 $ 60,489

Change in Retiree Medical Benefits Liability $ (2) $ (2)

Changes in Net Assets $ 26,025 $ 18,559

Changes in Net Assets beginning of year $ 2,030 $ 160,792

an

C

ge

h

n

i

s

Change in Net Assets from above

$ 18,559

26,025

Fund Balances

F u n d B ala n c e s Debt Service - Revenue Bonds (640) -

Capital Fund Transfers (19,500) -

Other Fund Transfers (70) -

Net Assets end of year $ 7,845 $ 179,351

en

em

a

S

t

Statement ASSETS $ 24,090 $ 111,462

t

t

Cash and Investments

of Financial

o f F i n a n c i al Pledges & Grants Receivable, net 4,965 7,436

-

s

i

i

Po

Position Park Improvements, net of accumulated depreciation 4,025 112,786

o

n

t

2,448

Other

Total Assets $ 33,080 $234,132

LIABILITIES AND NET ASSETS

Accounts Payable and Accrued Expenses $ 5,610 $ 5,730

Deferred Revenue 17,168 17,168

Revenue Bonds Payable, net - 29,296

Accrued Actuarial Benefit Obligations 2,445 2,445

Other 12 142

Total Liabilities $ 25,235 $ 54,781

Net Assets $ 7,845 $ 179,351

Total Liabilities and Net Assets $ 33,080 $ 234,132

FISCAL 2022 IMPACT REPORT 31