Page 71 - Export and Trade

P. 71

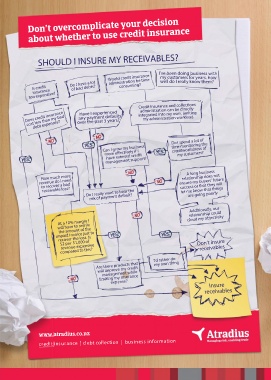

Don’t overcomplicate your decision

about whether to use credit insurance

SHOULD I INSURE MY RECEIVABLES?

I’ve been doing business with

Would credit insurance my customers for years. how

Do I have a lot administration be time well do I really know them?

consuming? g g g

Is credit of bad debts?

insurance

too expensive?

Credit insurance and collections

administration can be directly

Have I experienced

Does credit insurance over the past 3 years? integrated into my own, limiting

any payment defaults

cost less than my bad

my administration workload

m

a a

debt expenses?

I spend a lot of

w my business e monitoring the

ditworthiness of

hi

a

more effectively if ustomers?

m

s

have external cre

management sup

A long business

How much more relationship does not

revenue do I need ensure my buyers’ future

to recover a bad success or that they will

receivable loss? Do I really want to bear the let me know that things

are going poorly

risk of payment default?

Additionally, our

relationship could

cloud my objectivity

At a 10% margin I

will have to sell 9x

e

e e v

h h

the am nt of the

unpaid inv v oice just to

recover the loss. Is

h t th

$2 per $1,000 of Don’t insure

Don

D D

revenue expensive receivables

e e e

compared to this?

I’d rather do

Are there pr cts that my own thing

will improv

manage

limiting m

exp

Insure

receivables

atradius.co.nz

www. .a

credit ins urance | d ebt collection | business information