Page 198 - VIRANSH COACHING CLASSES

P. 198

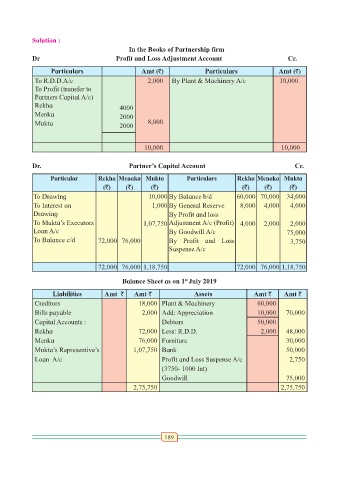

Solution :

In the Books of Partnership firm

Dr Profit and Loss Adjustment Account Cr.

Particulars Amt (`) Particulars Amt (`)

To R.D.D.A/c 2,000 By Plant & Machinery A/c 10,000

To Profit (transfer to

Partners Capital A/c)

Rekha 4000

Menka 2000

Mukta 2000 8,000

10,000 10,000

Dr. Partner’s Capital Account Cr.

Particular Rekha Menaka Mukta Particulars Rekha Menaka Mukta

(`) (`) (`) (`) (`) (`)

To Drawing 10,000 By Balance b/d 60,000 70,000 34,000

To Interest on 1,000 By General Reserve 8,000 4,000 4,000

Drawing By Profit and loss

To Mukta’s Executors 1,07,750 Adjustment A/c (Profit) 4,000 2,000 2,000

Loan A/c By Goodwill A/c 75,000

To Balance c/d 72,000 76,000 By Profit and Loss 3,750

Suspense A/c

72,000 76,000 1,18,750 72,000 76,000 1,18,750

Balance Sheet as on 1 July 2019

st

Liabilities Amt ` Amt ` Assets Amt ` Amt `

Creditors 18,000 Plant & Machinery 60,000

Bills payable 2,000 Add: Appreciation 10,000 70,000

Capital Accounts : Debtors 50,000

Rekha 72,000 Less: R.D.D. 2,000 48,000

Menka 76,000 Furniture 30,000

Mukta’s Representive’s 1,07,750 Bank 50,000

Loan A/c Profit and Loss Suspense A/c 2,750

(3750- 1000 Int)

Goodwill 75,000

2,75,750 2,75,750

189