Page 203 - VIRANSH COACHING CLASSES

P. 203

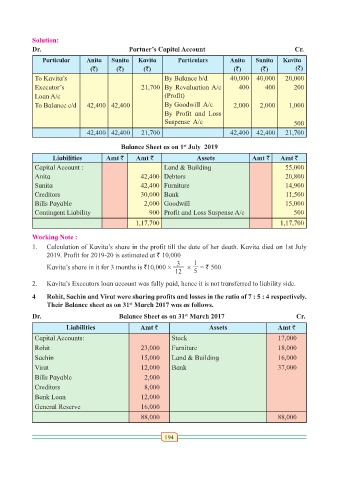

Solution:

Dr. Partner’s Capital Account Cr.

Particular Anita Sunita Kavita Particulars Anita Sunita Kavita

(`) (`) (`) (`) (`) (`)

To Kavita’s By Balance b/d 40,000 40,000 20,000

Executor’s 21,700 By Revaluation A/c 400 400 200

Loan A/c (Profit)

To Balance c/d 42,400 42,400 By Goodwill A/c 2,000 2,000 1,000

By Profit and Loss

Suspense A/c 500

42,400 42,400 21,700 42,400 42,400 21,700

st

Balance Sheet as on 1 July 2019

Liabilities Amt ` Amt ` Assets Amt ` Amt `

Capital Account : Land & Building 55,000

Anita 42,400 Debtors 20,800

Sunita 42,400 Furniture 14,900

Creditors 30,000 Bank 11,500

Bills Payable 2,000 Goodwill 15,000

Contingent Liability 900 Profit and Loss Suspense A/c 500

1,17,700 1,17,700

Working Note :

1. Calculation of Kavita’s share in the profit till the date of her death. Kavita died on 1st July

2019. Profit for 2019-20 is estimated at ` 10,000

3 1

Kavita’s share in it for 3 months is `10,000 × × = ` 500

12 5

2. Kavita’s Executors loan account was fully paid, hence it is not transferred to liability side.

4 Rohit, Sachin and Virat were sharing profits and losses in the ratio of 7 : 5 : 4 respectively.

st

Their Balance sheet as on 31 March 2017 was as follows.

st

Dr. Balance Sheet as on 31 March 2017 Cr.

Liabilities Amt ` Assets Amt `

Capital Accounts: Stock 17,000

Rohit 23,000 Furniture 18,000

Sachin 15,000 Land & Building 16,000

Virat 12,000 Bank 37,000

Bills Payable 2,000

Creditors 8,000

Bank Loan 12,000

General Reserve 16,000

88,000 88,000

194