Page 355 - VIRANSH COACHING CLASSES

P. 355

(6) Static statement : Financial Statements are static in nature. They represent absolute figures.

They do not present the process by which the figures are arrived.

(7) Affected by window dressing : Sometimes management displays rosy picture through

financial statement. In order to show excellent profit sales may be increased, closing stock

may be overvalued, purchases at the end of the year may not be shown. This may be known as

window dressing It is clear from the above limitations that the result obtained from analysis of

Financial Statements should not be taken as true indicator of financial strength and weakness

of the business.

These limitations must be kept in mind while taking decisions on the basis of analysis of

Financial Statements.

Analysis of Financial Statements.

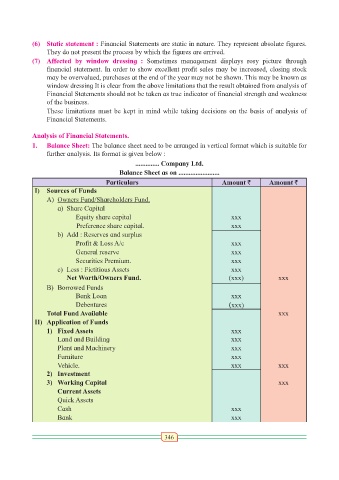

1. Balance Sheet: The balance sheet need to be arranged in vertical format which is suitable for

further analysis. Its format is given below :

.............. Company Ltd.

Balance Sheet as on ........................

Particulars Amount ` Amount `

I) Sources of Funds

A) Owners Fund/Shareholders Fund.

a) Share Capital

Equity share capital xxx

Preference share capital. xxx

b) Add : Reserves and surplus

Profit & Loss A/c xxx

General reserve xxx

Securities Premium. xxx

c) Less : Fictitious Assets xxx

Net Worth/Owners Fund. (xxx) xxx

B) Borrowed Funds

Bank Loan xxx

Debentures (xxx)

Total Fund Available xxx

II) Application of Funds

1) Fixed Assets xxx

Land and Building xxx

Plant and Machinery xxx

Furniture xxx

Vehicle. xxx xxx

2) Investment

3) Working Capital xxx

Current Assets

Quick Assets

Cash xxx

Bank xxx

346