Page 39 - VIRANSH COACHING CLASSES

P. 39

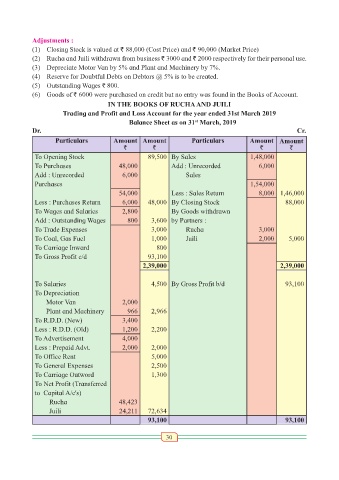

Adjustments :

(1) Closing Stock is valued at ` 88,000 (Cost Price) and ` 90,000 (Market Price)

(2) Rucha and Juili withdrawn from business ` 3000 and ` 2000 respectively for their personal use.

(3) Depreciate Motor Van by 5% and Plant and Machinery by 7%.

(4) Reserve for Doubtful Debts on Debtors @ 5% is to be created.

(5) Outstanding Wages ` 800.

(6) Goods of ` 6000 were purchased on credit but no entry was found in the Books of Account.

IN THE BOOKS OF RUCHA AND JUILI

Trading and Profit and Loss Account for the year ended 31st March 2019

st

Balance Sheet as on 31 March, 2019

Dr. Cr.

Particulars Amount Amount Particulars Amount Amount

` ` ` `

To Opening Stock 89,500 By Sales 1,48,000

To Purchases 48,000 Add : Unrecorded 6,000

Add : Unrecorded 6,000 Sales

Purchases 1,54,000

54,000 Less : Sales Return 8,000 1,46,000

Less : Purchases Return 6,000 48,000 By Closing Stock 88,000

To Wages and Salaries 2,800 By Goods withdrawn

Add : Outstanding Wages 800 3,600 by Partners :

To Trade Expenses 3,000 Rucha 3,000

To Coal, Gas Fuel 1,000 Juili 2,000 5,000

To Carriage Inward 800

To Gross Profit c/d 93,100

2,39,000 2,39,000

To Salaries 4,500 By Gross Profit b/d 93,100

To Depreciation

Motor Van 2,000

Plant and Machinery 966 2,966

To R.D.D. (New) 3,400

Less : R.D.D. (Old) 1,200 2,200

To Advertisement 4,000

Less : Prepaid Advt. 2,000 2,000

To Office Rent 5,000

To General Expenses 2,500

To Carriage Outword 1,300

To Net Profit (Transferred

to Capital A/c's)

Rucha 48,423

Juili 24,211 72,634

93,100 93,100

30