Page 35 - VIRANSH COACHING CLASSES

P. 35

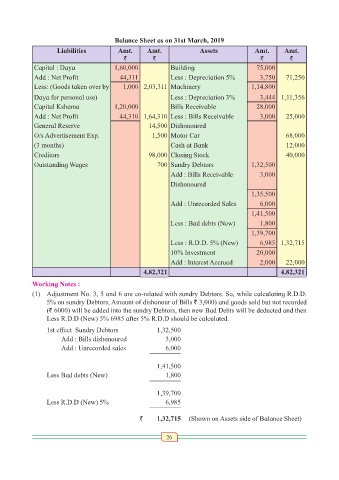

Balance Sheet as on 31st March, 2019

Liabilities Amt. Amt. Assets Amt. Amt.

` ` ` `

Capital : Daya 1,60,000 Building 75,000

Add : Net Profit 44,311 Less : Depreciation 5% 3,750 71,250

Less: (Goods taken over by 1,000 2,03,311 Machinery 1,14,800

Daya for personal use) Less : Depreciation 3% 3,444 1,11,356

Capital Kshama 1,20,000 Bills Receivable 28,000

Add : Net Profit 44,310 1,64,310 Less : Bills Receivable 3,000 25,000

General Reserve 14,500 Dishonoured

O/s Advertisement Exp. 1,500 Motor Car 68,000

(3 months) Cash at Bank 12,000

Creditors 98,000 Closing Stock 40,000

Outstanding Wages 700 Sundry Debtors 1,32,500

Add : Bills Receivable 3,000

Dishonoured

1,35,500

Add : Unrecorded Sales 6,000

1,41,500

Less : Bad debts (New) 1,800

1,39,700

Less : R.D.D. 5% (New) 6,985 1,32,715

10% Investment 20,000

Add : Interest Accrued 2,000 22,000

4,82,321 4,82,321

Working Notes :

(1) Adjustment No. 3, 5 and 6 are co-related with sundry Debtors. So, while calculating R.D.D.

5% on sundry Debtors, Amount of dishonour of Bills ` 3,000) and goods sold but not recorded

(` 6000) will be added into the sundry Debtors, then new Bad Debts will be deducted and then

Less R.D.D (New) 5% 6985 after 5% R.D.D should be calculated.

1st effect Sundry Debtors 1,32,500

Add : Bills dishonoured 3,000

Add : Unrecorded sales 6,000

1,41,500

Less Bad debts (New) 1,800

1,39,700

Less R.D.D (New) 5% 6,985

` 1,32,715 (Shown on Assets side of Balance Sheet)

26