Page 32 - VIRANSH COACHING CLASSES

P. 32

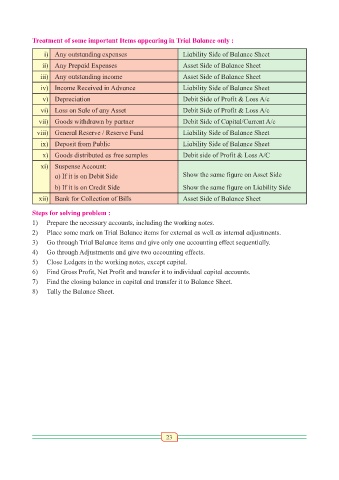

Treatment of some important Items appearing in Trial Balance only :

i) Any outstanding expenses Liability Side of Balance Sheet

ii) Any Prepaid Expenses Asset Side of Balance Sheet

iii) Any outstanding income Asset Side of Balance Sheet

iv) Income Received in Advance Liability Side of Balance Sheet

v) Depreciation Debit Side of Profit & Loss A/c

vi) Loss on Sale of any Asset Debit Side of Profit & Loss A/c

vii) Goods withdrawn by partner Debit Side of Capital/Current A/c

viii) General Reserve / Reserve Fund Liability Side of Balance Sheet

ix) Deposit from Public Liability Side of Balance Sheet

x) Goods distributed as free samples Debit side of Profit & Loss A/C

xi) Suspense Account:

a) If it is on Debit Side Show the same figure on Asset Side

b) If it is on Credit Side Show the same figure on Liability Side

xii) Bank for Collection of Bills Asset Side of Balance Sheet

Steps for solving problem :

1) Prepare the necessary accounts, including the working notes.

2) Place some mark on Trial Balance items for external as well as internal adjustments.

3) Go through Trial Balance items and give only one accounting effect sequentially.

4) Go through Adjustments and give two accounting effects.

5) Close Ledgers in the working notes, except capital.

6) Find Gross Profit, Net Profit and transfer it to individual capital accounts.

7) Find the closing balance in capital and transfer it to Balance Sheet.

8) Tally the Balance Sheet.

23