Page 71 - VIRANSH COACHING CLASSES

P. 71

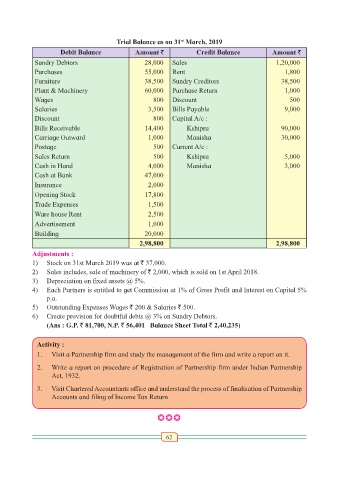

Trial Balance as on 31 March, 2019

st

Debit Balance Amount ` Credit Balance Amount `

Sundry Debtors 28,000 Sales 1,20,000

Purchases 55,000 Rent 1,800

Furniture 38,500 Sundry Creditors 38,500

Plant & Machinery 60,000 Purchase Return 1,000

Wages 800 Discount 500

Salaries 3,500 Bills Payable 9,000

Discount 800 Capital A/c :

Bills Receivable 14,400 Kshipra 90,000

Carriage Outward 1,000 Manisha 30,000

Postage 500 Current A/c :

Sales Return 500 Kshipra 5,000

Cash in Hand 4,000 Manisha 3,000

Cash at Bank 47,000

Insurance 2,000

Opening Stock 17,800

Trade Expenses 1,500

Ware house Rent 2,500

Advertisement 1,000

Building 20,000

2,98,800 2,98,800

Adjustments :

1) Stock on 31st March 2019 was at ` 37,000.

2) Sales includes, sale of machinery of ` 2,000, which is sold on 1st April 2018.

3) Depreciation on fixed assets @ 5%.

4) Each Partners is entitled to get Commission at 1% of Gross Profit and Interest on Capital 5%

p.a.

5) Outstanding Expenses Wages ` 200 & Salaries ` 500.

6) Create provision for doubtful debts @ 3% on Sundry Debtors.

(Ans : G.P. ` 81,700, N.P. ` 56,401 Balance Sheet Total ` 2,40,235)

Activity :

1. Visit a Partnership firm and study the management of the firm and write a report on it.

2. Write a report on procedure of Registration of Partnership firm under Indian Partnership

Act, 1932.

3. Visit Chartered Accountants office and understand the process of finalisation of Partnership

Accounts and filing of Income Tax Return

bbb

62