Page 76 - VIRANSH COACHING CLASSES

P. 76

of Fixed Asset. Capital Receipts are either added to Capital Fund or separately shown on

Liabilities side of Balance Sheet.

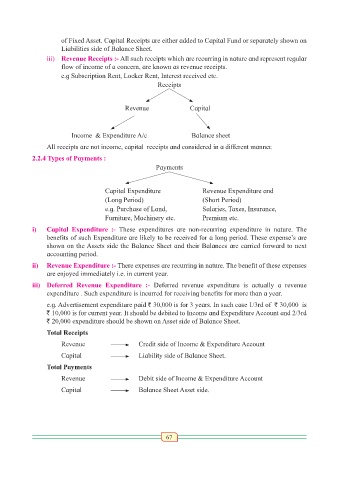

iii) Revenue Receipts :- All such receipts which are recurring in nature and represent regular

flow of income of a concern, are known as revenue receipts.

e.g Subscription Rent, Locker Rent, Interest received etc.

Receipts

Revenue Capital

Income & Expenditure A/c Balance sheet

All receipts are not income, capital receipts and considered in a different manner.

2.2.4 Types of Payments :

Payments

Capital Expenditure Revenue Expenditure and

(Long Period) (Short Period)

e.g. Purchase of Land, Salaries, Taxes, Insurance,

Furniture, Machinery etc. Premium etc.

i) Capital Expenditure :- These expenditures are non-recurring expenditure in nature. The

benefits of such Expenditure are likely to be received for a long period. These expense’s are

shown on the Assets side the Balance Sheet and their Balances are carried forward to next

accounting period.

ii) Revenue Expenditure :- There expenses are recurring in nature. The benefit of these expenses

are enjoyed immediately i.e. in current year.

iii) Deferred Revenue Expenditure :- Deferred revenue expenditure is actually a revenue

expenditure . Such expenditure is incurred for receiving benefits for more than a year.

e.g. Advertisement expenditure paid ` 30,000 is for 3 years. In such case 1/3rd of ` 30,000 is

` 10,000 is for current year. It should be debited to Income and Expenditure Account and 2/3rd

` 20,000 expenditure should be shown on Asset side of Balance Sheet.

Total Receipts

Revenue Credit side of Income & Expenditure Account

Capital Liability side of Balance Sheet.

Total Payments

Revenue Debit side of Income & Expenditure Account

Capital Balance Sheet Asset side.

67