Page 80 - VIRANSH COACHING CLASSES

P. 80

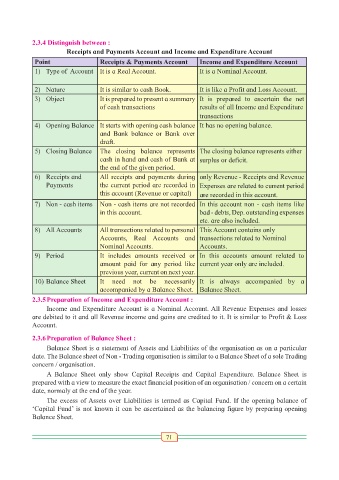

2.3.4 Distinguish between :

Receipts and Payments Account and Income and Expenditure Account

Point Receipts & Payments Account Income and Expenditure Account

1) Type of Account It is a Real Account. It is a Nominal Account.

2) Nature It is similar to cash Book. It is like a Profit and Loss Account.

3) Object It is prepared to present a summary It is prepared to ascertain the net

of cash transactions results of all Income and Expenditure

transactions

4) Opening Balance It starts with opening cash balance It has no opening balance.

and Bank balance or Bank over

draft.

5) Closing Balance The closing balance represents The closing balance represents either

cash in hand and cash of Bank at surplus or deficit.

the end of the given period.

6) Receipts and All receipts and payments during only Revenue - Receipts and Revenue

Payments the current period are recorded in Expenses are related to current period

this account (Revenue or capital) are recorded in this account.

7) Non - cash items Non - cash items are not recorded In this account non - cash items like

in this account. bad - debts, Dep. outstanding expenses

etc. are also included.

8) All Accounts All transections related to personal This Account contains only

Accounts, Real Accounts and transections related to Nominal

Nominal Accounts. Accounts.

9) Period It includes amounts received or In this accounts amount related to

amount paid for any period like current year only are included.

previous year, current on next year.

10) Balance Sheet It need not be necessarily It is always accompanied by a

accompanied by a Balance Sheet. Balance Sheet.

2.3.5 Preparation of Income and Expenditure Account :

Income and Expenditure Account is a Nominal Account. All Revenue Expenses and losses

are debited to it and all Revenue income and gains are credited to it. It is similar to Profit & Loss

Account.

2.3.6 Preparation of Balance Sheet :

Balance Sheet is a statement of Assets and Liabilities of the organisation as on a particular

date. The Balance sheet of Non - Trading organisation is similar to a Balance Sheet of a sole Trading

concern / organisation.

A Balance Sheet only show Capital Receipts and Capital Expenditure. Balance Sheet is

prepared with a view to measure the exact financial position of an organisation / concern on a certain

date, normaly at the end of the year.

The excess of Assets over Liabilities is termed as Capital Fund. If the opening balance of

‘Capital Fund’ is not known it can be ascertained as the balancing figure by preparing opening

Balance Sheet.

71