Page 83 - VIRANSH COACHING CLASSES

P. 83

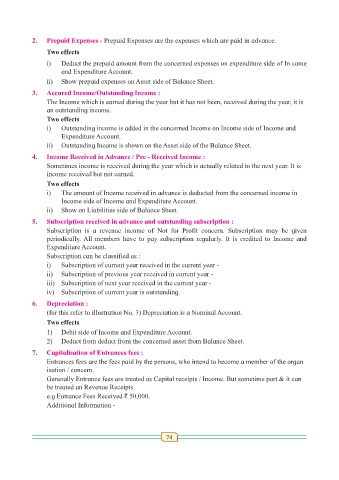

2. Prepaid Expenses - Prepaid Expenses are the expenses which are paid in advance.

Two effects

i) Deduct the prepaid amount from the concerned expenses on expenditure side of In come

and Expenditure Account.

ii) Show prepaid expenses on Asset side of Balance Sheet.

3. Accured Income/Outstanding Income :

The Income which is earned during the year but it has not been, received during the year, it is

an outstanding income.

Two effects

i) Outstanding income is added in the concerned Income on Income side of Income and

Expenditure Account.

ii) Outstanding Income is shown on the Asset side of the Balance Sheet.

4. Income Received in Advance / Pre - Received Income :

Sometimes income is received during the year which is actually related to the next year. It is

income received but not earned.

Two effects

i) The amount of Income received in advance is deducted from the concerned income in

Income side of Income and Expenditure Account.

ii) Show on Liabilities side of Balance Sheet.

5. Subscription received in advance and outstanding subscription :

Subscription is a revenue income of Not for Profit concern. Subscription may be given

periodically. All members have to pay subscription regularly. It is credited to Income and

Expenditure Account.

Subscription can be classified as :

i) Subscription of current year received in the current year -

ii) Subscription of previous year received in current year -

iii) Subscription of next year received in the current year -

iv) Subscription of current year is outstanding.

6. Depreciation :

(for this refer to illustration No. 3) Depreciation is a Nominal Account.

Two effects

1) Debit side of Income and Expenditure Account.

2) Deduct from deduct from the concerned asset from Balance Sheet.

7. Capitalisation of Entrances fees :

Entrances fees are the fees paid by the persons, who intend to become a member of the organ

isation / concern.

Generally Entrance fees are treated as Capital receipts / Income. But sometime part & it can

be treated an Revenue Receipts.

e.g Entrance Fees Received ` 50,000.

Additional Information -

74