Page 86 - VIRANSH COACHING CLASSES

P. 86

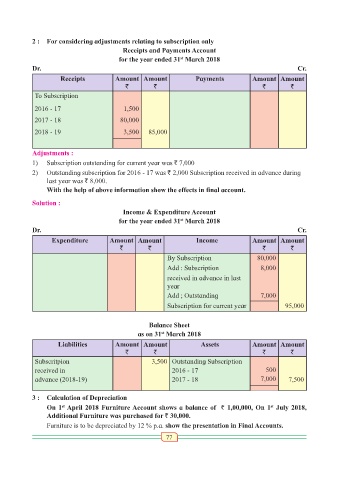

2 : For considering adjustments relating to subscription only

Receipts and Payments Account

for the year ended 31 March 2018

st

Dr. Cr.

Receipts Amount Amount Payments Amount Amount

` ` ` `

To Subscription

2016 - 17 1,500

2017 - 18 80,000

2018 - 19 3,500 85,000

Adjustments :

1) Subscription outstanding for current year was ` 7,000

2) Outstanding subscription for 2016 - 17 was ` 2,000 Subscription received in advance during

last year was ` 8,000.

With the help of above information show the effects in final account.

Solution :

Income & Expenditure Account

st

for the year ended 31 March 2018

Dr. Cr.

Expenditure Amount Amount Income Amount Amount

` ` ` `

By Subscription 80,000

Add : Subscription 8,000

received in advance in last

year

Add ; Outstanding 7,000

Subscription for current year 95,000

Balance Sheet

as on 31 March 2018

st

Liabilities Amount Amount Assets Amount Amount

` ` ` `

Subscritpion 3,500 Outstanding Subscription

received in 2016 - 17 500

advance (2018-19) 2017 - 18 7,000 7,500

3 : Calculation of Depreciation

st

st

On 1 April 2018 Furniture Account shows a balance of ` 1,00,000, On 1 July 2018,

Additional Furniture was purchased for ` 30,000.

Furniture is to be depreciated by 12 % p.a. show the presentation in Final Accounts.

77