Page 89 - VIRANSH COACHING CLASSES

P. 89

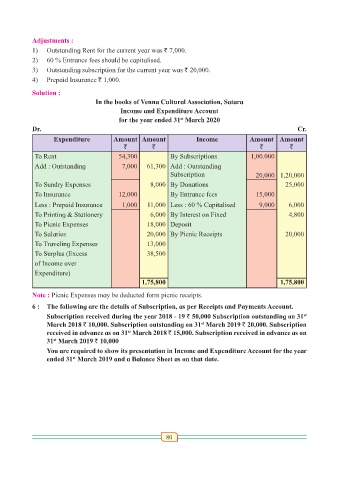

Adjustments :

1) Outstanding Rent for the current year was ` 7,000.

2) 60 % Entrance fees should be capitalised.

3) Outstanding subscription for the current year was ` 20,000.

4) Prepaid Insurance ` 1,000.

Solution :

In the books of Venna Cultural Association, Satara

Income and Expenditure Account

for the year ended 31 March 2020

st

Dr. Cr.

Expenditure Amount Amount Income Amount Amount

` ` ` `

To Rent 54,300 By Subscriptions 1,00.000

Add : Outstanding 7,000 61,300 Add : Outstanding

Subscription 20,000 1,20,000

To Sundry Expenses 8,000 By Donations 25,000

To Insurance 12,000 By Entrance fees 15,000

Less : Prepaid Insurance 1,000 11,000 Less : 60 % Capitalised 9,000 6,000

To Printing & Stationery 6,000 By Interest on Fixed 4,800

To Picnic Expenses 18,000 Deposit

To Salaries 20,000 By Picnic Receipts 20,000

To Traveling Expenses 13,000

To Surplus (Excess 38,500

of Income over

Expenditure)

1,75,800 1,75,800

Note : Picnic Expenses may be deducted form picnic receipts.

6 : The following are the details of Subscription, as per Receipts and Payments Account.

Subscription received during the year 2018 - 19 ` 50,000 Subscription outstanding on 31

st

March 2018 ` 10,000. Subscription outstanding on 31 March 2019 ` 20,000. Subscription

st

st

received in advance as on 31 March 2018 ` 15,000. Subscription received in advance as on

31 March 2019 ` 10,000

st

You are required to show its presentation in Income and Expenditure Account for the year

ended 31 March 2019 and a Balance Sheet as on that date.

st

80