Page 12 - Report Card Vol. 9

P. 12

NEW OPPORTUNITIES WITH

529 PLANS

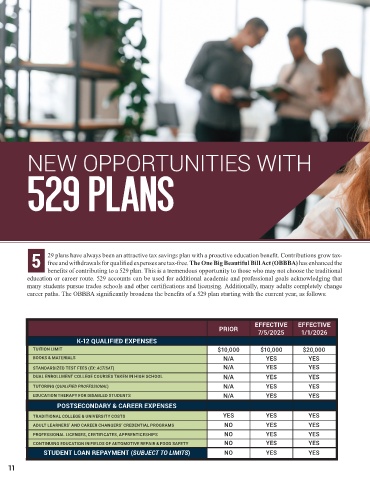

5 29 plans have always been an attractive tax savings plan with a proactive education benefit. Contributions grow tax- For those looking to save additional amounts beyond the Some additional changes impacting ABLE accounts are

free and withdrawals for qualified expenses are tax-free. The One Big Beautiful Bill Act (OBBBA) has enhanced the

as follows:

limit of the 529 plans, the OBBBA also created a new

benefits of contributing to a 529 plan. This is a tremendous opportunity to those who may not choose the traditional program called the Money Accounts for Growth and ► Employed individuals can contribute more than the

education or career route. 529 accounts can be used for additional academic and professional goals acknowledging that Advancement (MAGA) which can be funded up to annual limit. The ABLE-to-Work provision would have

many students pursue trades schools and other certifications and licensing. Additionally, many adults completely change $5,000 per year. These contributions can be from a parent expired in 2025 but is not permanent.

career paths. The OBBBA significantly broadens the benefits of a 529 plan starting with the current year, as follows: or guardian for a child under the age of 8 and any gains ► Contributions to ABLE accounts up to $2,000 are

would be taxed at long-term capital gains rates when used eligible for 50% saver’s credit (max of $1,000)

for higher education expenses, a first-time home purchase

or starting a small business. Funds that are withdrawn ► Account eligibility expands to individuals whose

EFFECTIVE EFFECTIVE for other purposes will be taxed at ordinary income tax disability began before age 46 (no longer before age 26).

PRIOR 7/5/2025 1/1/2026 rates with penalties. Any MAGA account opened for a This is effective January 1, 2026.

K-12 QUALIFIED EXPENSES child who was a US Citizen at birth and born between

TUITION LIMIT $10,000 $10,000 $20,000 January 1, 2025 and January 1, 2029 can receive a one- Work with your families to help them take advantage of

these enhancements which make the 529 plans even more

BOOKS & MATERIALS N/A YES YES time contribution of $1,000 directly from the Federal attractive than just the tax-free growth.

STANDARDIZED TEST FEES (EX: ACT/SAT) N/A YES YES government. The $1,000 deposits will commence January

1, 2026.

DUAL ENROLLMENT COLLEGE COURSES TAKEN IN HIGH SCHOOL N/A YES YES KIMBERLY ROFFI, CPA

TUTORING (QUALIFIED PROFESSIONAL) N/A YES YES The Achieving a Better Life Experience (ABLE) PARTNER

EDUCATION THERAPY FOR DISABLED STUDENTS N/A YES YES accounts also benefit from the OBBBA. Families who

POSTSECONDARY & CAREER EXPENSES have 529 plans but want to transfer funds into ABLE

accounts only had until December 31, 2025 to do so. The

TRADITIONAL COLLEGE & UNIVERSITY COSTS YES YES YES OBBBA has removed the expiration date and rollovers

ADULT LEARNERS’ AND CAREER CHANGERS’ CREDENTIAL PROGRAMS NO YES YES from 529 plans into ABLE accounts are now permitted

PROFESSIONAL LICENSES, CERTIFICATES, APPRENTICESHIPS NO YES YES beyond 2025.

CONTINUING EDUCATION IN FIELDS OF AUTOMOTIVE REPAIR & FOOD SAFETY NO YES YES

STUDENT LOAN REPAYMENT (SUBJECT TO LIMITS) NO YES YES

11 12