Page 11 - Reeftankers - Annexure B Sasfin

P. 11

PART D

REGULATION 28 COMPLIANCE

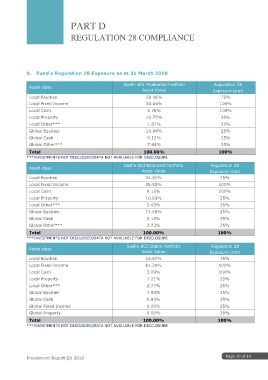

6. Fund’s Regulation 28 Exposure as at 31 March 2018

Sasfin BCI Prudential Portfolio Regulation 28

Asset class

Asset Value Exposure Limit

Local Equities 29.16% 75%

Local Fixed Income 33.64% 100%

Local Cash 5.76% 100%

Local Property 10.77% 25%

Local Other*** 1.67% 25%

Global Equities 10.94% 25%

Global Cash 0.12% 25%

Global Other*** 7.94% 25%

Total 100.00% 100%

***INVESTMENTS NOT DISCLOSED/DATA NOT AVAILABLE FOR DISCLOSURE

Asset class Sasfin BCI Balanced Portfolio Regulation 28

Asset Value Exposure Limit

Local Equities 24.31% 75%

Local Fixed Income 35.92% 100%

Local Cash 9.15% 100%

Local Property 10.83% 25%

Local Other*** 2.43% 25%

Global Equities 14.48% 25%

Global Cash 0.15% 25%

Global Other*** 2.73% 25%

Total 100.00% 100%

***INVESTMENTS NOT DISCLOSED/DATA NOT AVAILABLE FOR DISCLOSURE

Asset class Sasfin BCI Stable Portfolio Regulation 28

Asset Value Exposure Limit

Local Equities 16.87% 75%

Local Fixed Income 61.30% 100%

Local Cash 3.09% 100%

Local Property 7.21% 25%

Local Other*** 2.77% 25%

Global Equities 7.93% 25%

Global Cash 0.83% 25%

Global Fixed Income 0.00% 25%

Global Property 0.00% 25%

Total 100.00% 100%

***INVESTMENTS NOT DISCLOSED/DATA NOT AVAILABLE FOR DISCLOSURE

Page 10 of 14

Investment Report Q1 2018