Page 95 - Policy Wording - Hollard Business Binder (2020-08-26)

P. 95

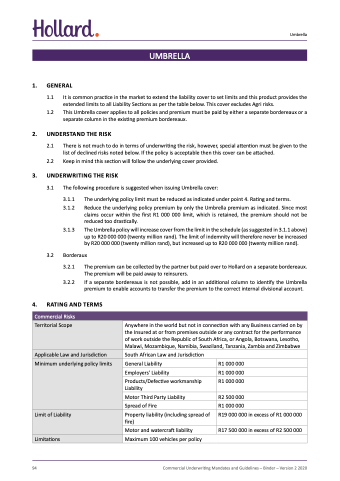

4. RATING AND TERMS

Umbrella

1. GENERAL

UMBRELLA

1.1 It is common practice in the market to extend the liability cover to set limits and this product provides the extended limits to all Liability Sections as per the table below. This cover excludes Agri risks.

1.2 This Umbrella cover applies to all policies and premium must be paid by either a separate bordereaux or a separate column in the existing premium bordereaux.

2. UNDERSTAND THE RISK

2.1 There is not much to do in terms of underwriting the risk, however, special attention must be given to the list of declined risks noted below. If the policy is acceptable then this cover can be attached.

2.2 Keep in mind this section will follow the underlying cover provided.

3. UNDERWRITING THE RISK

3.1 The following procedure is suggested when issuing Umbrella cover:

3.1.1 The underlying policy limit must be reduced as indicated under point 4. Rating and terms.

3.1.2 Reduce the underlying policy premium by only the Umbrella premium as indicated. Since most claims occur within the first R1 000 000 limit, which is retained, the premium should not be reduced too drastically.

3.1.3 The Umbrella policy will increase cover from the limit in the schedule (as suggested in 3.1.1 above) up to R20 000 000 (twenty million rand). The limit of indemnity will therefore never be increased by R20 000 000 (twenty million rand), but increased up to R20 000 000 (twenty million rand).

3.2 Borderaux

3.2.1 The premium can be collected by the partner but paid over to Hollard on a separate bordereaux. The premium will be paid away to reinsurers.

3.2.2 If a separate bordereaux is not possible, add in an additional column to identify the Umbrella premium to enable accounts to transfer the premium to the correct internal divisional account.

Commercial Risks

Territorial Scope

Minimum underlying policy limits

Anywhere in the world but not in connection with any Business carried on by the Insured at or from premises outside or any contract for the performance of work outside the Republic of South Africa, or Angola, Botswana, Lesotho, Malawi, Mozambique, Namibia, Swaziland, Tanzania, Zambia and Zimbabwe

Applicable Law and Jurisdiction

Limit of Liability

Limitations

South African Law and Jurisdiction

General Liability

Employers' Liability

Products/Defective workmanship Liability

Motor Third Party Liability Spread of Fire

Property liability (including spread of fire)

Motor and watercraft liability Maximum 100 vehicles per policy

R1 000 000 R1 000 000 R1 000 000

R2 500 000

R1 000 000

R19 000 000 in excess of R1 000 000

R17 500 000 in excess of R2 500 000

94

Commercial Underwriting Mandates and Guidelines – Binder – Version 2 2020