Page 33 - NYMets_2018_Benefits_Guide

P. 33

BACK TO

HOME

PLATE

2018 employee Contributions

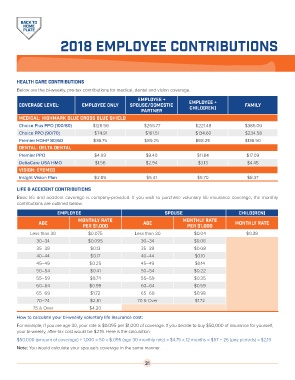

Health Care Contributions

Below are the bi-weekly, pre-tax contributions for medical, dental and vision coverage.

employee +

Coverage Level: Employee only spouse/domestic employee + family

child(ren)

partner

medical: Highmark Blue cross blue Shield

Choice Plus PPO (100/80) $126.56 $265.77 $221.48 $386.00

Choice PPO (90/70) $74.91 $161.51 $134.60 $234.58

Premier HDHP 80/60 $36.75 $89.25 $68.25 $136.50

dental: delta dental

Premier PPO $4.99 $9.40 $11.84 $17.09

DeltaCare USA HMO $1.56 $2.94 $3.13 $4.45

vision: EyeMed

Insight Vision Plan $2.85 $5.41 $5.70 $8.37

Life & Accident Contributions

Basic life and accident coverage is company-provided. If you wish to purchase voluntary life insurance coverage, the monthly

contributions are outlined below.

Employee spouse Child(ren)

monthly rate monthly rate

age age monthly rate

per $1,000 per $1,000

Less than 30 $0.075 Less than 30 $0.04 $0.38

30–34 $0.095 30–34 $0.06

35–39 $0.13 35–39 $0.08

40–44 $0.17 40–44 $0.10

45–49 $0.25 45–49 $0.14

50–54 $0.41 50–54 $0.22

55–59 $0.74 55–59 $0.35

60–64 $0.99 60–64 $0.59

65–69 $1.72 65–69 $0.98

70–74 $2.81 70 & Over $1.72

75 & Over $4.20

How to calculate your bi-weekly voluntary life insurance cost:

For example, if you are age 30, your rate is $0.095 per $1,000 of coverage. If you decide to buy $50,000 of insurance for yourself,

your bi-weekly, after-tax cost would be $2.19. Here is the calculation:

$50,000 (amount of coverage) ÷ 1,000 = 50 x $.095 (age 30 monthly rate) = $4.75 x 12 months = $57 ÷ 26 (pay periods) = $2.19

Note: You would calculate your spouse’s coverage in the same manner.

31