Page 18 - Gi_November2020

P. 18

gas takes centre stage

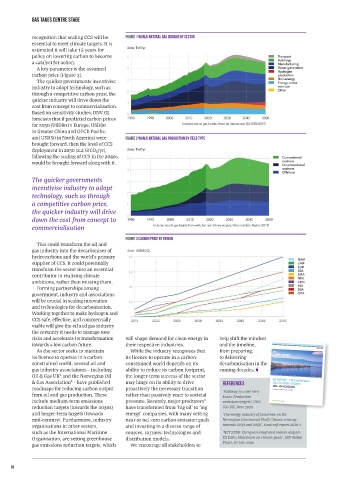

recognition that scaling CCS will be FIGURE 1 WORLD NATURAL GAS DEMAND BY SECTOR

essential to meet climate targets. It is

estimated it will take 15 years for

policy on lowering carbon to become

a catalyst for action.

A key parameter is the assumed

carbon price (Figure 3).

The quicker governments incentivise

industry to adopt technology, such as

through a competitive carbon price, the

quicker industry will drive down the

cost from concept to commercialisation.

Based on sensitivity studies, DNV GL

forecasts that if predicted carbon prices

for 2050 (USD80 in Europe, USD60

in Greater China and OECD Pacific,

and USD50 in North America) were FIGURE 2 WORLD NATURAL GAS PRODUCTION BY FIELD TYPE

brought forward, then the level of CCS

deployment in 2050 (2.2 GtCO₂/yr),

following the scaling of CCS in the 2040s,

would be brought forward along with it.

The quicker governments

incentivise industry to adopt

technology, such as through

a competitive carbon price,

the quicker industry will drive

down the cost from concept to

commercialisation

FIGURE 3 CARBON PRICE BY REGION

This could transform the oil and

gas industry into the decarboniser of

hydrocarbons and the world’s primary

supplier of CCS. It could potentially

transform the sector into an essential

contributor in realising climate

ambitions, rather than missing them.

Forming partnerships among

government, industry and associations

will be crucial in scaling innovation

and technologies for decarbonisation.

Working together to make hydrogen and

CCS safe, effective, and commercially

viable will give the oil and gas industry

the certainty it needs to manage new

risks and accelerate its transformation will shape demand for clean energy in help shift the mindset

towards a low carbon future. their respective industries. and the timeline,

As the sector seeks to maintain While the industry recognises that from preparing,

its licence to operate in a carbon- its licence to operate in a carbon- to delivering

constrained world, several oil and constrained world depends on its decarbonisation in the

gas industry associations – including ability to reduce its carbon footprint, coming decades.

Oil & Gas UK¹ and the Norwegian Oil the longer-term success of the sector

& Gas Association² – have published may hinge on its ability to drive References

roadmaps for reducing carbon output proactively the necessary transition

from oil and gas production. These rather than passively react to societal ‘Pathway to a net-zero

basin: Production

include medium-term emissions pressure. Recently, major producers³ emissions targets’, Oil &

reduction targets (towards the 2030s) have transformed from ‘big oil’ to ‘big Gas UK, June 2020

and longer-term targets (towards energy’ companies, with many setting ‘The energy industry of tomorrow on the

mid-century). Furthermore, industry near or net zero carbon emission goals Norwegian Continental Shelf: Climate strategy

organisations in other sectors, and investing in a diverse range of towards 2030 and 2050’, KonKraft report 2020-1

such as the International Maritime sources, carriers, technologies and ‘NET ZERO: European integrated majors outpace

Organisation, are setting greenhouse distribution models. US E&Ps, Midstream on climate goals’, S&P Global

gas emissions reduction targets, which We encourage all stakeholders to Platts, 27 July 2020

18

15/10/2020 10:59

DNVGLEnergyOutlook.indd 3

DNVGLEnergyOutlook.indd 3 15/10/2020 10:59